IPOS

2019-06-13Tax for Non-Resident Director

2019-06-19

Partial Tax Exemption

Partial Income tax Exemptions

| Year of Assessment (YA) |

Tax rate | Tax exemption/ rebate | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2013 and subsequent YAs | 17% | Partial tax exemption and tax exemption scheme for new start-up companies

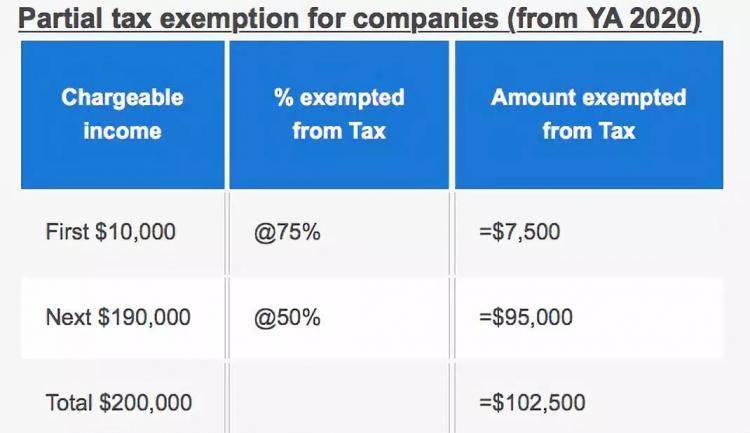

Companies can enjoy the partial tax exemption and tax exemption for new start-up companies, as provided in the tables below. Partial tax exemption for companies (from YA 2020)

Tax exemption scheme for new start-up companies (where any of the first 3 YAs falls in or after YA 2020)

Partial tax exemption for companies (YA 2019 and before)

Tax exemption scheme for new start-up companies (where any of the first 3 YAs falls in or before YA 2019)

|

Corporate Income Tax (CIT) Rebate for YAs 2013 to 2020

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580