Personal Income Tax Rate

2019-08-13

Foreign-Sourced Income

2019-09-13

Other Banking Services

Full Bank

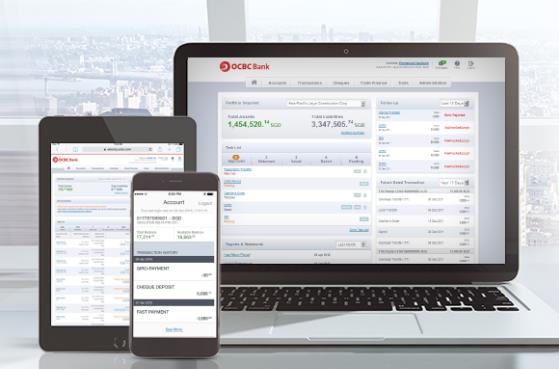

Full-service banks offer all banking services permitted under the Banking Act of Singapore. The following local banks offer a full range of banking services, including demand deposit accounts, ATMs, credit and debit cards, loans, mortgages, etc. These banks have the most extensive branch network. Customers can use any of the banks’ ATMs. OCBC Bank and UOB share an ATM system, so customers of both banks can use the ATMs of one of the banks.

The local full banks are:

Development Bank of Singapore (DBS)

United Overseas Bank (UOB)

Overseas Chinese Bank (OCBC)

Wholly foreign-owned banks with Qualified Foreign Bank (“QFB”) privileges may operate up to 25 branches. They may also offer the following services:

- Shared ATMs and the freedom to move their branches.

- Commercial negotiations with local banks to allow credit card holders to obtain cash advances through the local bank’s ATM network.

- Providing debit card services through the EFTPOS network.

- Provision of Supplementary Retirement Plan and Provident Fund Investment Plan accounts

- Time deposits accepted

Not all foreign banks offer a full range of banking services, and the types and amounts of services offered vary widely. Depending on their partnership agreements with local banks, they can offer a limited number of ATM sites. Ask them about their arrangements when opening an account. Examples of foreign banks with QFB privileges:

- Citibank

- Standard Chartered Bank

- Hong Kong and Shanghai Banking Corporation (HSBC)

- Bank of China (BOC)

Wholesale Banks

Wholesale banks are allowed to conduct the same banking business as regular banks, except that they operate as branches of foreign banks and are not allowed to engage in Singapore dollar retail business. They are not allowed to provide the following services without prior approval from MAS:

- Operating savings accounts denominated in Singapore dollars

- Operate savings accounts denominated in foreign currencies, both local bank accounts and Asian currency accounts.

- Time deposits are accepted, provided that the minimum initial deposit amount for a time deposit is S$250,000.

- They can operate a current account, but if the current account is in Singapore dollars and the customer is a natural person and resident of Singapore, the current account must not be interest-bearing

Offshore Bank

For businesses transacting through Asian Currency Units (ACUs), offshore banks can engage in the same activities as full banks and wholesale banks. The ACU is a unit of account that banks use to record all foreign currency transactions conducted in the Asian money market (ADM). The Singapore dollar transactions of these banks are recorded separately in the domestic banking unit (DBU).

Typical operations of commercial banks in Singapore include

- Corporate Finance

- Underwriting stock and bond issues

- Mergers and acquisitions

- Portfolio management

- management consultant

- Other fee-based activities

Most commercial banks are able to compete with other commercial banks in Asian financial markets. While commercial banks may not accept deposits or borrow from the public, they may accept deposits or borrow from banks, finance companies, shareholders, and shareholder-controlled companies.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580