Application Process

2017-08-10

Who Needs to File ECI

2017-08-22

Letter of Credit

What is a letter of credit?

A letter of credit (LC) is a commonly used trade finance tool to ensure that payment for goods and services will be made between the buyer and the seller. The rules for LCs are issued and defined by the International Chamber of Commerce (ICC) through its Uniform Documentary Letter of Credit Practice (ucp600), which is used by producers and traders worldwide. The parties issue the letter of credit through an intermediary, a bank or financial institution, and are legally guaranteed that the goods or services received will be paid for.

The relationship between buyer and seller is largely based on trust. Whether you are the buyer, seller or end user of a product or service, it is important to understand the intentions of the other parties when transacting overseas and to ensure that they fulfil their own obligations in the transaction. If you are trading domestically (within the same region) then it is usually easier to establish a relationship with your supplier, but what happens if your supplier is less well-known (perhaps overseas)? Although around 80% of global trade is conducted on an open account basis (buy now, pay later), suppliers are now often demanding full payment in advance. For businesses, a line of credit not only provides some form of reassurance that your goods will be protected but also offers flexible payment terms, all of which can be achieved through a letter of credit.

How letters of credit are used

Letters of credit are issued and formatted per the guidelines of the Uniform Customs and Practice for Documentary Credits (UCP600) issued by the International Chamber of Commerce (ICC). Using one is fairly simple, both for businesses selling and buying goods and services.

One of the parties, usually the importer, will contact the bank to act as an intermediary and assure the seller that the goods will be paid for as agreed. All parties involved need to agree to these terms and sign the contract. This greatly reduces the risk of doing business, as letters of credit are legally binding documents that are recognized in 175 countries around the world.

While the guidelines and letters of credit are largely the same, the content is not. Both the buyer and seller must scrutinize the documents to check for errors that could cause delays, further costs or delayed payments. In this regard, even a small oversight can be very expensive and it is advisable to have several groups of people check the documents.

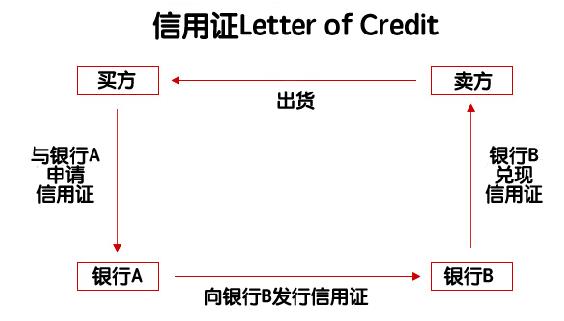

Letters of credit work as follows.

The terms of the letter of credit include:

- Notifying the Bank – Accepting and notifying the beneficiary of the letter of credit.

- Confidence banks — Financial institutions that agree to honour letters of credit to beneficiaries and accept payment from advising banks.

- Irrevocable Letter of Credit – A letter of credit that cannot be amended unless all parties agree to it.

- Issuing bank/issuing bank – The party issuing the letter of credit.

- Tip – If the payment/letter of credit is accepted, delivery of the letter of credit document and any other required documents requested by the beneficiary.

- A revocable letter of credit – a letter of credit that can be revoked, amended or cancelled at any time by the issuing party.

- Standby – the most common type of letter of credit, payment under certain conditions.

Who needs a letter of credit?

Letters of credit are useful for any business that deals in large volumes, whether domestically or across borders. They are important to ensure a company’s cash flow and reduce the risk of default due to non-payment by end customers.

Also, letters of credit can benefit companies that build their businesses around e-commerce or services.

Some considerations when deciding whether to request a letter of credit may include:

- The associated costs and risks of non-payment, and which party will bear those costs

- Legal requirements and expertise

- Documents required (proof of shipment, dispatch of goods, such as customs declarations and insurance documents)

- Credentials of suppliers/customers

Overseas companies

International traders and wholesale producers of goods are the main users of letters of credit. Such companies need to be sure that they will not lose money by selling to unfamiliar overseas buyers.

If unfortunately, the recipient of the goods is unwilling or unable to pay the seller, the letter of credit will be activated and the bank will be obliged to pay the missing amount under the terms of the agreement. Upon completion of payment by the interlocutor, the bank will deal with the buyer per the domestic law of the buyer’s country.

Internet companies

Online, e-commerce and service businesses often use letters of credit to enter into overseas contracts. For companies producing software or other online services that require significant resources, it is important to consider external financing to free up working capital.

Small or medium-sized enterprise (SME)

Small and medium-sized enterprises (SMEs) make up 99% of all businesses. Letters of credit can help alleviate some of the cash flow constraints from late and long-term payment terms for end customers. Large international companies are often the main culprits for late payments by SMEs, which can often put smaller companies under financial strain or even out of business.

Advantages of using letters of credit

Risk and trust are one of the main challenges to trade, both domestic and international. The specificity and legal importance of letters of credit are a major advantage, as they are accepted and recognized by 175 countries, reduce the risk of doing business abroad, and provide a transparent way for unfamiliar parties to cooperate.

Finally, the letters of credit provide better transaction clarity, as all goods or services provided will be defined in detail. This provides additional comfort to the buyer while eliminating the possibility that the description of the ordered goods differs greatly from the end product.

Key Benefits:

- Avoid potential disputes overseas

- Provide some form of payment guarantee to the seller/supplier

- Flexibility and variability between different types of LCs

- Secure payment methods accepted in most major markets

- The risk of non-payment is borne by the bank, not the buyer

- Usually requested by national border/exchange management agencies

Different Types of LC

There are different types of LCs depending on the type of business or transaction that requires them. In most cases, these secondary features are used to improve security and make operations easier, faster, and more transparent.

While there is a time and place for each type of LC, the business should be aware that some of the required riders or clauses may increase the cost to the bank or add features that could cause future problems for the parties involved.

1. Irrevocable

An irrevocable letter of credit allows the buyer to cancel or amend the letter of credit with the consent of the other party. This can be used to trade goods other than the original letter of credit in the same shipment or to give product exporters additional time to meet their obligations.

2. Confirmed LC

A confirmed letter of credit is used to increase the seller’s security. This additional clause states that the seller’s bank guarantees payment if the issuing bank fails to pay the requested amount from the buyer.

This clause can be added if confidence in the buyer is diminished or if the requested funds are critical to the seller’s stable financial liquidity.

Most letters of credit include this clause in the agreement, especially in international trade between countries that have not cooperated in the past.

3. Transferable

Negotiable letters of credit are usually used for intermediaries involved in a transaction, or where the letter of credit contains more than two parties. In such cases, the letter of credit can be transferred to another entity as long as the original beneficiary agrees.

This approach is often used by the seller’s bank, especially if the seller is an SME, as a way to reduce the risk of the transaction to the bank, and usually to reduce the price of the transaction in the process.

4. Demand letters of credit

This clause in the letter of credit states that all payments will be made as soon as the buyer receives the documents for the goods or services. This payment can be made by the buyer or by the buyer’s issuing bank, giving the buyer some additional time to repay the debt.

Contrary to this type of letter of credit, there is a standby letter of credit that does not have this clause and needs to be activated if the buyer is unable to pay for the goods.

5. Extended or forward letters of credit

This type of letter of credit allows the buyer to defer payment for a specified period of time. This slightly reduces the risk of unintentional refusal to pay and reduces the cost of the letter of credit. Also, extended letters of credit are more attractive to the buyer, making them more likely to accept the purchase of goods or services.

6. Red clause

A red clause letter of credit requires the buyer’s issuing bank to provide partial payment to the seller before the shipment of the product or provision of services. It is often used to secure a supplier and expedite the shipping process, but it tends to make the letter of credit significantly more expensive.

Whether you are a seller or buyer of goods and services, using a letter of credit can give a great boost to your business. This trading tool is legally binding in almost every country in the world, provides better transparency, and creates trust in your business.

Using a letter of credit, you can do business with any company or business around the world while being certain that all agreed-upon goods will be received and all payments will be honoured.

For any company, access to the global market means lower prices and better service. In addition, it means that you can safely offer your goods and services to any buyer around the world without the risk of not being paid for the products you provide.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580