2018-05-02

Local Payments GIRO What is GIRO? The GIRO is a tripartite mechanism between the billing institution, the customer and the bank. The authorization of direct debits is a contractual relationship between the consumer and the purchase offer; the bank is the intermediary in this tripartite relationship and helps implement the authorized direct debits. Today, GIROs are widely used by consumers to pay bills to government agencies and the private sector. Direct transfers are particularly useful for payments that are fixed in nature and amount. In the public sector, GIRO has become the only means of payment for some fees, such […]

2018-04-27

Withholding Tax Requirements Who Are Non-Resident Companies or Individuals To determine whether withholding tax is applicable, the Payer has to ascertain that the payment was made to a company or an individual who is Non-Resident in Singapore. Non-Resident Company A company is either a tax resident or a non-resident of Singapore. In Singapore, the tax residency of a company is determined by the place in which the business is controlled and managed. “Control and management” is the making of decisions on strategic matters, such as those on company policy and strategy. Where the control and management of a company is […]

2018-04-24

Strike Off Company If a company in Singapore decides to cease doing business, it can apply to the Accounting and Corporate Regulatory Authority of Singapore (ACRA) to have its name removed from the Companies Register, a process known as “striking off”. Firstly, the company should pay unpaid taxes. For a company to successfully apply for cancellation of the company with ACRA, the company must not owe any tax liabilities and obligations to the Inland Revenue Authority of Singapore (IRAS), otherwise, the IRAS will oppose the company’s cancellation application. Therefore, a company must ensure that all outstanding tax obligations and liabilities […]

2018-04-19

Documents required for opening a bank account To open an account with a bank in Singapore, the following documents are generally required: Account Opening Application Form -Prepared by the bank with which you are opening an account The Board of Directors’ resolution approves the opening of an account in the bank and affirms the authorized signatories and their authority. (Requires the signatures of two directors or a director and company secretary)-Prepared by the selected bank Cheque book application form (If you need to apply for a cheque book, please fill in the form and indicate the currency and quantity. Otherwise, […]

2018-04-19

Share Allotment A private limited company in Singapore is limited in terms of shares when it is registered. The shares of each shareholder of the company are calculated according to the number of shares held by each person and how much each share is worth. At different times, the shares of different investors may have different nominal values. This shareholding structure facilitates later changes in the company such as the issuance of additional shares, transfers, premiums, etc. When the company needs to issue additional equity shares, it first needs to pass a board resolution to decide how many new shares […]

2018-04-09

Employer’s Documents The Fair Consideration Framework (FCF) sets out the requirements for all employers in Singapore to consider candidates fairly for job opportunities. Before hiring foreign employees, companies need to provide job opportunities to locals (citizens or permanent residents). Therefore, before submitting an EP application for a foreign employee, the company must publish a job advertisement on a public recruitment website in Singapore. EP applications can only be submitted 14 days after the advertisement is published. Sites where ads can be posted: mycareersfuture.sg jobstreet.com.sg jobscentral.com.sg and many more The advertisements issued by the company must be fair and open, and must not […]

2018-04-05

Withholding Tax Filing Extension of Withholding Tax Filing and Payment Due Date New! In light of the latest measures to manage the COVID-19 situation, the filing due date for all S45 Withholding Tax Forms due in Apr 2020 will be automatically extended to 15 May 2020. The payment due date will also be extended to 15 May 2020. For those on GIRO and who file by 15 April 2020, the deduction date remains as 25 Apr 2020. If GIRO deduction is unsuccessful, a second GIRO deduction will be automatically scheduled for 25 May 2020. For those on GIRO and who file by […]

2018-03-07

Audit Process An audit is a formal examination of the financial accounts of an individual, business or organization. Internal audits are conducted by members of the same organization or enterprise, while external audits may be conducted by regulatory or governmental bodies. Appointment of Auditors For Singapore companies that meet the audit requirements, the directors of the company must appoint the auditors within three months of the company’s incorporation. The term of office of the auditor is from the date of his appointment to the conclusion of the next annual general meeting of the company. Therefore, when an auditor is first […]

2018-03-07

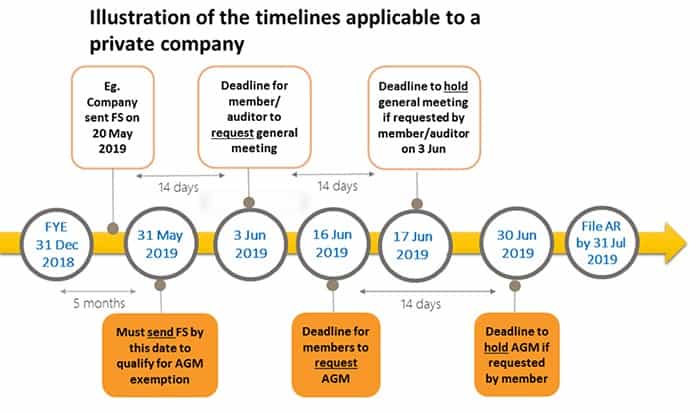

Annual Return Timeline In accordance with the relevant provisions of the Singapore Companies Act Cap 175, 197, 201, a company whose financial year ends after 31 August 2018 is required to file its annual return on time. For newly registered companies, the first financial year must end within 18 months. The financial year of a company in Singapore is calculated on the basis of 12 natural months. After the end of the company’s financial year: Listed companies : Must hold a general meeting of shareholders of the company within 4 months. The annual return must be submitted within 5 months. […]

2018-03-02

GST Registered Company GST Registered Company With effect from 1 January 2019, your company should register for GST if its annual taxable turnover exceeds S $1 million during the 12-month period ending each calendar year. That is, your company must register for GST if it is determined that its taxable income will exceed S$1 million in the next 12 months. The projections must be supported by the following documents. Signed contracts or agreements Accepted quotations or confirmed purchase orders from customers Invoices to customers Past P&L statements showing annual turnover of nearly S $1 million for the past 12 months and […]

2018-03-01

Taxable and Non-Taxable Income Taxable and Non-Taxable Income All income earned in or derived from Singapore is chargeable to income tax. Generally, overseas income received in Singapore on or after 1 Jan 2004 is not taxable, except in some circumstances. Income earned may come from different sources such as: Employment Trade, Business, Profession or Vocation Property or Investments Other Sources (e.g. annuities, royalties, winnings or estate or trust income) Income from Employment Salary, Bonus, Director’s Fee, Commission and Others Gains from the Exercise of Stock Options Income Received from Overseas Pension Retrenchment and Retirement Benefits Income from Trade, Business, Profession […]

2018-02-21

Annual Return Documents Companies doing annual audits need to prepare the relevant documents in advance, which include but are not limited to: Financial Report Directors’ reports and directors’ statements Independent auditor’s report (if applicable) Consolidated income statement (profit and loss account) Statement of financial position (balance sheet) Cash flow statement Statement of shareholders’ equity Corresponding notes to the financial statements Director’s Statement. Exempt Company Statement (if applicable). Solvency Statement. Adoption of financial statements resolution. Waiver of audit resolution (if applicable). Consent of company members. Other relevant documents. All of the above documents need to be signed by the relevant […]

2018-02-21

XBRL Filing XBRL (eXtensible Business Reporting Language) is an XML-based markup language for defining and exchanging business and financial information. After you’ve done your accounting, you need to convert your existing financial reports into XBRL format according to XBRL’s formatting and classification requirements. During the conversion process, the XBRL software also compares and validates the data in the company’s financial reports. Since 2014, the Singapore government has required companies to file their financial statements in Extensible Business Reporting Language (XBRL). XBRL is an XML-based format for business documents for exchanging financial information for financial documents. The format is open source […]