2019-07-10

Accounting Requirements The accounting standards prescribed in Singapore (“Singapore Financial Reporting Standards” or SFRS) are consistent with those of the International Accounting Standards Board (IASB). The Accounting Standards Council of Singapore (ASC) develops, reviews, amends and approves accounting standards for use by companies, charities, co-operatives and general societies. Listed companies may also use IFRS standards with the permission of the securities regulator. Foreign companies whose equity securities are primarily listed in Singapore must adopt SFRS, IFRS standards or US GAAP. However, Singapore companies can choose the periodicity of doing the accounts according to their business and government requirements. Some companies […]

2019-06-24

Pay GST How to Pay GST GIRO is the preferred method of payment. GIRO Majority of taxpayers use GIRO for tax payment. Electronic Payment Modes PayNow QR New! Internet Banking Bill Payment Internet Banking for tax payment is made available by the following banks: BOC CIMB Citibank DBS/POSB HSBC ICBC MayBank OCBC RHB Standard Chartered Bank State Bank of India UOB (BOC, CIMB, Citibank, ICBC, MayBank, RHB and State Bank of India are applicable for individual account holders only). DBS PayLah! Mobile App Pay your tax via DBS PayLah! Phone Banking Phone Banking service for DBS/POSB, OCBC and UOB account holders who have subscribed to this service. (DBS/POSB and OCBC are applicable for individual account holders only.) […]

2019-06-19

Tax for Non-Resident Director Whether withholding tax is applicable depends on the residency status of the board director. Board Director For tax purposes, a board director is a member of the board of directors of a company. Residency Status of Board Director Physical presence in Singapore in the year preceding the Year of Assessment (YA) Residency status Withholding Tax required Less than 183 days Non-Resident Yes, for remuneration paid to non-resident director. For details, refer to Tax Obligations for Non-Resident Directors 183 days or more Resident No. If tax has been withheld, see also Tax Refunds for Resident Directors Executive Director […]

2019-06-18

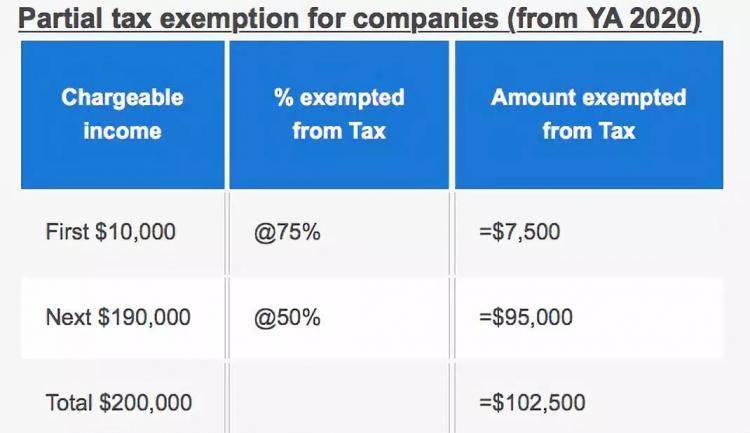

Partial Tax Exemption Partial Income tax Exemptions Year of Assessment (YA) Tax rate Tax exemption/ rebate 2013 and subsequent YAs 17% Partial tax exemption and tax exemption scheme for new start-up companies Companies can enjoy the partial tax exemption and tax exemption for new start-up companies, as provided in the tables below. Partial tax exemption for companies (from YA 2020) Chargeable income % exempted from Tax Amount exempted from Tax First $10,000 @75% =$7,500 Next $190,000 @50% =$95,000 Total $200,000 =$102,500 Tax exemption scheme for new start-up companies (where any of the first 3 YAs falls in or after YA 2020) Chargeable […]

2019-06-13

IPOS Intellectual Property Office of Singapore (IPOS) The Intellectual Property Office of Singapore is a government agency under the Ministry of Law. The Intellectual Property Office of Singapore provides advice and management on intellectual property laws, raises awareness of intellectual property rights, and provides infrastructure to promote the development of intellectual property in Singapore. Since October 9, 2015, IPOS has been appointed as the International Searching Authority and International Preliminary Examining Authority for patent applications filed under the Patent Cooperation Treaty. International surveys agreed that Singapore’s intellectual property system is one of the best in the world. In the “2019 […]

2019-05-16

Director’s Duty Under Singapore law, any company document requires the signatures of the directors of the company to take effect. Without these signatures, a document which has been stamped with the company seal has no legal effect. In the case of a company resolution, at least two directors’ signatures are required. The board resolution requires the consent of a majority of the directors (more than 50%). If there are a large number of directors, a director can be authorized to sign the documents after the board has passed a resolution. In establishing a company in Singapore, there is no concept […]

2019-05-03

Duty of Statutory Secretary Like any other director in the company, the statutory secretary is the officer in the company and under the Companies Act, the secretary is required to do the following: Maximize the company’s profits Avoid conflicts of interest Be responsible and conscientious in their work Not obtain illegal benefits for the company through private transactions. In smaller companies, the company secretary is usually responsible for administrative duties such as recording and registering company documents and financial filings. In larger companies, the company secretary is responsible for a wider range of administrative tasks, such as ensuring that the […]

2019-05-03

Second Directorship Qualified companies can appoint EP employment pass holders of other related companies to the board of directors. Who applies: Employers who intend to appoint EP holders as members of the board of directors. Application time: within 5 weeks Documents Required: Letter of Appointment for Person Holding EP Employment Pass as Director Appointed directors need to perform the corresponding responsibilities of directors per Singapore’s Company Law. For employers: 1. You must ensure that the employer does not object to the person holding the EP pass as a director. 2. You must obtain approval from the Ministry of Manpower by […]

2019-04-26

Loss Carry-Back Relief Companies may carry-back unutilised capital allowances (CAs) and trade losses arising in a Year of Assessment (YA) to reduce the amount of taxes payable in an immediately preceding YA. Background of the scheme To help small businesses cope with cash-flow problems especially in cyclical downturns, a one-year carry-back of current year unutilised CAs and trade losses was introduced effective YA 2006. The Loss Carry-Back Relief complements the existing policy of companies being able to carry forward their unutilised CAs and trade losses to setoff future incomes (i.e. loss carry-forward) or transfer unutilised CAs and trade losses to related […]

2019-04-18

2019-04-17

Director Resolution As the director of a Singaporean company, you must hold a board meeting if you need to discuss and pass resolutions on matters relating to the current and future state of the company. FOZL Singapore has summarised tips on how to conduct a board meeting below for your reference. The objective of the Board A board meeting is a meeting of a company’s board of directors at which the directors discuss company business and pass resolutions to make decisions about the company. Such business may include. Business expansion plans Property acquisition Review of financial reports Recruitment of talents […]

2019-04-16

Employment Contract After establishing their company in Singapore, many businesses need to hire local Singaporean employees. So, how should an employment contract be formulated? FOZL will now take you through the formulation of the employment contract. Singapore Basic Employment Terms and Conditions To avoid misunderstandings, it is recommended that both parties formulate and clearly state the terms and conditions of employment in employment contracts (written employment contracts or employment letters). The employment contract should include the following: • Job position • Scope of work, that is, the responsibilities that must be performed • Employment start date/ date of work • […]

2019-04-04

Main Business Activity There are 2 main scopes of business that can be registered on the company registration document. The main scope refers to the two businesses that account for the highest percentage of revenue amongst the company’s various businesses. Companies are permitted to partake in businesses that are not listed in the main scope of business. **If you are dealing with restricted industries or products, you need to apply to the relevant government departments and obtain a licence. For example, food, restaurants, medical products, tobacco, alcohol, automobiles, etc.. If there is a change in the main source of income […]