2020-02-29

Tax Clearance for Foreign Employee Give Notice to Your Employer Your employer must file the Form IR21 at least one month before you cease employment with them, go on an overseas posting or leave Singapore for more than three months. For example, if you tender your resignation on 14 Aug 2020 with your last day of employment being 13 Oct 2020, your employer is required to file the Form IR21 by 14 Sep 2020. Hence, please give sufficient notice to your employer so that they can file the Form IR21 for you early. This will also give you time to settle […]

2019-12-02

Taxable Income For Singapore tax purposes, taxable income refers to: The proceeds or profits of any trade or business. Investment income such as dividends, interest and rent. Royalties, insurance premiums and any other property profits. Other gains that are revenue in nature Deductions such as business expenses, capital allowances and reliefs can be claimed to reduce taxable income, which will result in a lower taxes. Business Expenses Business expenses are the costs you pay to run your business. Some examples are Central Provident Fund contributions, salaries, renovations, advertising, etc. Business expenses may or may not be deductible. When deducted, they […]

2019-11-20

Food Import Licence All companies wishing to import, export, or trans-ship food products must be registered and licensed by the Singapore Food Authority in accordance with the relevant laws of Singapore. Permits are required for the following. Import, export, or transit of meat and fish products. Import or transit of fresh fruit and vegetables. Imported fresh edible eggs Also, registration is required in the following cases. Import of processed food and food utensils (e.g., pots, blenders, rice cookers, etc.). For more information, see the Food and Food Products Category Guide: https://www.sfa.gov.sg/food-import-export/general-classification-of-food-food-products Companies that need to apply for registration […]

2019-11-19

Financial Report Compliance Financial reporting needs to meet the requirements of the Singapore Financial Reporting Standards in many aspects. Director’s Statement: Recipient of director’s statement If the company has only one shareholder, the term “to shareholders” should be used. Directors’ opinions When there is an event or situation that casts serious doubts on the company’s solvency, the directors’ opinions should be revised accordingly and appropriately disclosed. Signing the director’s statement If the company has only two or fewer directors, there is no need to use the term “representative of the board of directors” when signing the director’s statement. If the […]

2019-11-09

Liquor Licence According to Singapore law, all companies or individuals who wish to import, wholesale or retail liquor are required to obtain the relevant licence or permit. As liquor is a strictly regulated product, a liquor licence needs to be filed with the Singapore Police Force. Each licence has its own restrictions, such as the method of sale (wholesale, retail), the place of sale, the hours during which the sale is permitted, and so on. If you violate the relevant regulations, the following penalties may apply: Fines not exceeding $ 20,000; Imprisonment not exceeding 3 months; In cases of repeated […]

2019-11-06

Corporate Tax Corporate income tax rate Companies, whether local or foreign, are taxed at a flat rate of 17% of their taxable income. General rule for all companies All Singapore companies are required to pay tax on income from the previous financial year. The income from the 2019 Financial Year will be taxed in 2020. Base period and year of assessment For tax purposes, using the same example above, 2020 is the year of assessment (YA). In other words, YA is the year in which your income is assessed for taxation. In order to assess the tax, the Inland Revenue […]

2019-10-16

Withholding Tax Rate Withholding Tax Rates for Services, Interest, Royalty, Rent of Movable Properties, etc. Nature of Income Tax Rate Interest, commission, fee or other payment in connection with any loan or indebtedness 15% 1 Royalty or other lump sum payments for the use of moveable properties 10% 12 Royalty and other payment made to author, composer or choreographer 22% 2 Payment for the use of or the right to use scientific, technical, industrial or commercial knowledge or information 10% 12 Rent or other payments for the use of moveable properties 15% 1 Technical assistance and service fees Prevailing Corporate Tax rate 35 Management fees Prevailing […]

2019-10-03

GST Computation How It Works Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT. GST exemptions apply to the provision of most financial services, the supply of digital payment tokens, the sale and lease of residential properties, and the importation and local supply of investment precious metals. Goods that are exported and international services are zero-rated. Taxable and Non-Taxable Goods and Services The table below lists […]

2019-09-23

Who Needs To Pay GST When doing business in Singapore, it is important for companies to understand the Singapore Goods and Services Tax (GST). GST is also known as the value-added tax (VAT) in other countries, and is levied on the supply of goods and services in Singapore and the import of goods into Singapore. Businesses are required to submit quarterly GST returns to the Inland Revenue Authority of Singapore (IRAS). GST-registered companies in Singapore can engage in a variety of activities, both commercial and non-commercial in nature. A taxable person is not entitled to claim input tax credit in […]

2019-09-13

Foreign-Sourced Income The Tax Exemption A Singapore tax resident company can enjoy tax exemption on its specified foreign income that is remitted into Singapore. Categories of Foreign-Sourced Income The three categories of specified foreign income are: Foreign-sourced dividend; Foreign branch profits; and Foreign-sourced service income. Qualifying Conditions for Tax Exemption Under Section 13(9) of the Income Tax Act, tax exemption will be granted when all of the following three conditions are met : The foreign income had been subject to tax in the foreign jurisdiction from which they were received (known as the “subject to tax” condition). The rate at which the […]

2019-08-15

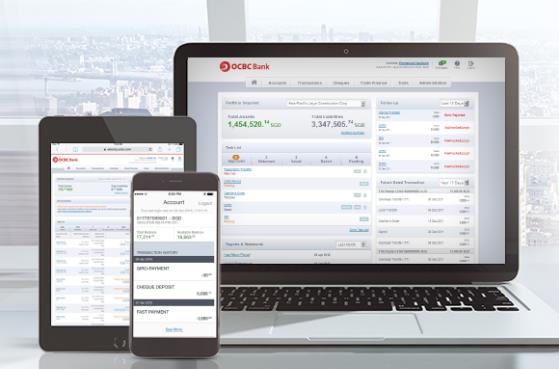

Other Banking Services Singapore is strategically located, with a well-developed infrastructure, and is a hub for trade and financial services in the Asian region. The financial services industry has been a major source of economic growth in Singapore since the 1970s, and the government has continued to provide incentives for the development of the banking and services industry in Singapore. Commercial banks in Singapore are licensed and governed under the Banking Act and are allowed to conduct universal banking business. Commercial banks are licensed, take deposits, provide cheque services and loans, and any other business regulated or authorised by the […]

2019-08-13

Personal Income Tax Rate Income tax rates depend on an individual’s tax residency status. You will be treated as a tax resident for a particular Year of Assessment (YA) if you are a: Singapore Citizen (SC) or Singapore Permanent Resident (SPR) who resides in Singapore except for temporary absences; or Foreigner who has stayed / worked in Singapore (excludes director of a company) for 183 days or more in the year preceding the YA. Otherwise, you will be treated as a non-resident of Singapore for tax purposes. Resident Tax Rates From YA 2017 onwards Chargeable Income Income Tax Rate (%) Gross Tax Payable ($) First $20,000 Next […]

2019-07-23

Corporate Income Tax Rate Year of Assessment (YA) Tax rate Tax exemption/ rebate 2013 and subsequent YAs 17% Partial tax exemption and tax exemption scheme for new start-up companies Companies can enjoy the partial tax exemption and tax exemption for new start-up companies, as provided in the tables below. Partial tax exemption for companies (from YA 2020) Chargeable income % exempted from Tax Amount exempted from Tax First $10,000 @75% =$7,500 Next $190,000 @50% =$95,000 Total $200,000 =$102,500 Tax exemption scheme for new start-up companies (where any of the first 3 YAs falls in or after YA 2020) Chargeable income % exempted […]