2020-03-23

Exempted private limited company means a private limited company incorporated in Singapore and: The company has no direct or indirect institutional shareholders. (All shareholders of the company are natural persons) The company has less than or equal to 20 shareholders. The company is considered a qualified exempt company. Qualified exempted companies in Singapore can enjoy many things to do: Government compliance requirements for companies are relatively simple. Companies can submit XBRL filings differently. The annual audit of the company is not required to submit the company’s financial statements. More lending and financial flexibility: According to the Singapore Companies Act, if […]

2020-03-23

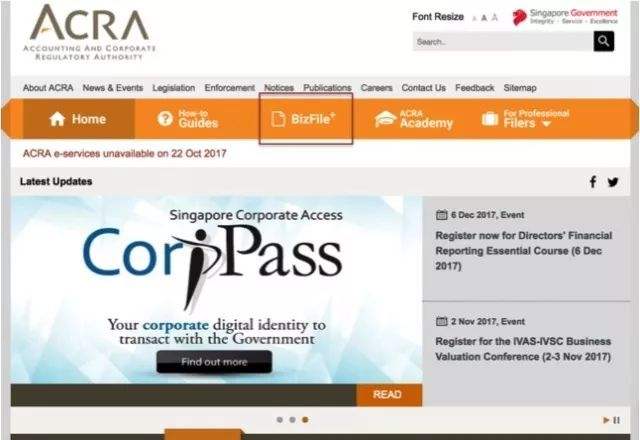

After the Annual General Meeting, in accordance with “the Singapore Companies Act” S175, S197 and S201requires that a local company in Singapore need to do the company’s annual returns to ARCA Singapore Accounting and Corporate Regulatory Authority During the annual returns, the company needs to submit the latest information to ACRA, which contains important details of the company, such as the name of the director, the secretary, its members, and the date of preparation of the company’s financial statements. The following information is required to submit the annual review: Company information, such as company type, business scope, registered […]

2020-03-20

Company operation, you may also need a business secretary in addition to the legal secretary Singapore company business secretarial services include: Collection and distribution of company letters (the customer bears the postage cost) Assist the customer to view and process the English letters received (with the authorization of the customer) ** An authorization letter for processing the letter and a disclaimer letter are required Customer parcel forwarding (customer bears delivery cost) Call forwarding, SMS, WeChat, Email reminder service Visiting customer reception General company operation consulting Singapore FOZL Group Pte. Ltd. Singapore Accounting and Corporate Regulatory Authority licensed corporate […]

2020-03-20

If a Singapore company decides to cease its business, it can apply to the Singapore Accounting and Enterprise Regulatory Authority (ACRA) to remove the company name from the company registration list, a process known as “Striking off.” Let ’s take a look at the whole process with Sister Zhilin! First, the company should pay unpaid taxes; To successfully apply to ACRA for the cancellation of a company, the company must not owe any tax taxes and liabilities to the Singapore Inland Revenue Department. Otherwise, the Inland Revenue Department will object to the company’s cancellation application. Therefore, the company must ensure that all […]

2020-03-20

As a Singapore company director, if you need to discuss matters related to the company’s current and future status and pass resolutions, you need to convene a board meeting. Singapore Fu Zhilin summarizes the small knowledge of the board meeting for your reference. 01 Clarify the board and its purpose A board meeting is a meeting of the company’s board of directors, where the directors discuss the company’s affairs and pass resolutions to make decisions about the company. These transactions may include: Business Expansion Plan Property acquisition Review of financial reports Talent recruitment If directors reach consensus on certain issues, they may […]

2020-03-20

A private limited company in Singapore is a joint-stock private limited company at the time of registration. The shares of each shareholder of the company are calculated according to the number of shares held by each person and the amount of each share. Different periods, different investors’ equity may have different face values. This kind of equity structure is conducive to the company’s later equity issuance, transfer, premium and other changes. When the company needs to issue additional shares. The company needs to pass a resolution of the board of directors to decide how many new shares the company needs […]

2020-03-20

It is one of the important responsibilities of company directors to ensure the authenticity and validity of company information in real time. If the information of a Singapore company changes, the company directors have the responsibility to promptly notify the statutory secretary of the company to submit an application for change of information to the Accounting and Enterprise Control Authority of Singapore (ACRA). If the following information of the company changes, the company must declare the change information to ACRA through Bizfile + within 14 days. Singapore Company Main Business Singapore Company Registered Address Company Hours Company Member Registration Form […]

2020-03-19

Like other directors in a company, the company’s Nominee Secretary is the officer in the company. Under Singapore Company Act, the secretary needs to do the following: maximize company benefits Avoid conflicts of interest Be responsible and diligent at work Do not obtain illegal benefits for the company through private transactions / Do not obtain illegal benefits with the company through private transactions In smaller companies, the company’s Nominee Secretary usually performs administrative tasks such as recording company documents and related registrations, and financial reporting. In large companies, the Nominee Secretary generally assumes more job responsibilities, such as ensuring […]

2020-03-19

When registering a company in Singapore, you need a Nominee Secretary. The Nominee Secretary is not an ordinary office secretary! All companies registered in Singapore need to have at least one resident staff in Singapore as the company’s Nominee Secretary when registering. It is the responsibility of the company’s board of directors to appoint a company secretary and determine the salary package for that secretary. Company directors need to ensure that qualified people are selected as the company’s Nominee Secretary. Finding a qualified Singapore resident as the company’s Nominee Secretary is to ensure that this person understands […]

2020-03-19

ACRA, Singapore’s Accounting and Corporate Regulatory Authority, recently issued an updated requirement! After January 1, 2018, Singapore companies need to use CorpPass to log in to the Singapore Accounting and Corporate Regulatory Authority website for any transactions, and Singpass will no longer be allowed to use as a corporate identity. Editor Fu Zhilin specially shared this dry goods with everyone ~ let’s take a look together! From March 25, 2017, all Singapore companies will need to use the new corporate digital identity CorpPass to conduct related online business with ACRA , the Singapore Accounting and Corporate Regulatory Authority . The launch of CorpPass is intended to […]

2020-03-19

Singapore company registration requires a Singapore registered address. This is so that letters and documents can reach your company address and make it easier for others to contact the company. However, the company’s registered address does not have to be where your business actually operates . Some companies, especially smaller ones or offshore companies whose shareholders are not in Singapore, use the address of their business secretarial service company as their registered address after payment. This arrangement is perfectly fine as long as there is an actual registration Address as a way to contact the company. When a company uses the address of its […]

2020-03-19

The financial year is the executive year of the company’s financial settlement. In some countries, the financial year is stipulated to end on December 31 of each year. In some countries, the company is encouraged to end the financial year in March, June, September, or December each year. Companies incorporated in Singapore are free to choose the end of the financial year. Therefore, the financial year of the company can end in any month of the year. Normally, the first financial year does not exceed 18 months. The following financial year is calculated in 12 months. If the company has […]

2020-03-19

When a Singapore company is incorporated, you need to know the difference between authorized registered capital and real capital.