2020-08-17

Share Transfer In situations where company directors and shareholders need to transfer shares to other shareholders, the following information must be noted: Crucial Information A typical equity transfer occurs when: A shareholder owns a minority stake in the business and wishes to achieve a return on their investment through a share transfer. Companies use employee share ownership schemes where employees change jobs after having already acquired shares and need to sell their shares through a share transfer. Founders of a company sell their shares through a share transfer in order to raise capital or exit the company. It is […]

2020-08-17

Company Folder After the company is registered, we will prepare a complete company package for our clients. The package contains all the statutory documents, stamps and templates. The documents in the package should be kept in a secure location. Any subsequent changes, resolutions, or new documents should also be logged and kept in the company folder. This is equivalent to the company’s files. The company packet should include: Certificate of Incorporation (business license) Certificate of Incorporation Company registration document Bizfile Articles of Association Constitution Form 45 Consent to Act as Director Form 45BForm 45B Consent to Act as Secretary Application […]

2020-08-17

Choosing a company name Before registering a company, the first thing to do is to check if the name which the company is registering is available. How to tell if a company name can be registered Generally, if a company with the same name does not already exist, you can apply for it within a day or several hours. However, when the submitted company name contains certain professional terms, these company names will have to be referred to the relevant Singapore regulators. If this happens, it may take 14 days to 2 months for the company name to be reviewed and approved. Which are […]

2020-08-17

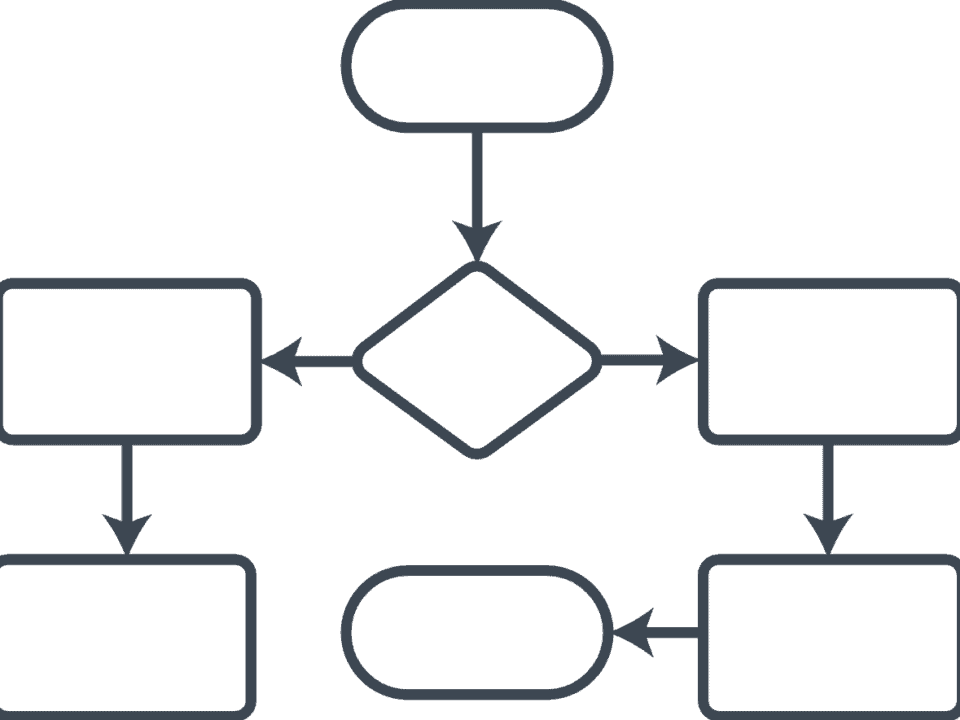

Incorporation Process 1 Fill in the registration application form Including: company name, registered address, main business scope, registered capital, directors, shareholders 3 Company name review The company name can include words like “Singapore, Group”, but not sensitive words. 5 Open a bank account FOZL will make an appointment with the bank-to-public account manager in advance. Go through the account opening procedures immediately after your company registration is successful. During the Covid-19 period, FOZL will provide free appointments online for customers who may not able to meet our bankers in person. 2 Sign a contract Sign a contract and pay the […]

2020-08-17

Singapore Company Types There are many types of business entities in Singapore. Before registering, you should be aware of the kind of business entity that is best for your company. According to the Singapore Business Registration Act, all individuals or institutions conducting business in Singapore are required to register with the Accounting and Corporate Regulatory Authority (ACRA), and any details about changes in the owner, managers or business partners must be made known to ACRA within the specified time period. Singapore corporations include private and public limited companies Private limited companies can be registered with less than 50 shareholders Public companies […]

2020-08-17

Why Register Your Company in Singapore? Legend has it that in the 14th century, a Sumatran prince saw a magical beast, which he later learned was a lion, as soon as he set foot on the island of Singapore. In 1819, Stamford Raffles, an Englishman, shaped Singapore into a trading transit point. Singapore’s free trade policy attracted businessmen from all over Asia, the United States and even the Middle East. The country gained independence on August 9, 1965, became a member of the United Nations in September, and joined the Commonwealth in October of the same year. Singapore Overview Population: […]

2020-08-17

为什么注册新加坡公司 公元 14 世纪时,传说有一位苏门答腊王子一踏上这座小岛就看见一头神奇的野兽,后来得知是头狮子。就此,王子就将这座小岛命名为“Singapura” 即狮城 的意思。1819年,英国人史丹福莱佛士(Stamford Raffles),将新加坡塑造为一个贸易中转站。新加坡的自由贸易政策吸引了亚洲各地,甚至美国和中东的商人。1965年8月9日新加坡获得独立。同年9月成为联合国成员国,10月加入英联邦。 国际总部 现有约2.6万国际公司 金融中心 全球第四大外汇交易中心 研发中心 知识产权保护全球第二 新加坡人才资源 新加坡的劳动力排名稳居榜首。美国商业环境风险调查机构 (BERI) 的劳动力评估新加坡排名第一。新加坡一向拥有生产效率高、技术娴熟的劳动队伍,使其成为业务发展的有利地点,并拥有卓越的业务成绩和先进的技术、低廉的单位劳动力成本,同时还生产出高价值的商品和服务。拥有亚洲最良好的劳资关系。在新加坡一般的工作场所,雇员与雇主之间的关系是本区域最好的。更开放的通讯渠道及和谐的劳资关系,使得新加坡有更好的工作环境及更高的生产效率。亲商的外国人才移民法规。新加坡便利的地理位置使其成为外国人才理想的聚集中心。根据洛桑国际管理学院的报告,新加坡的劳动力政策相对开放,非常亲商并重视外来人才。在新加坡,大约四分之一的技术熟练工人来自于海外。在新加坡工作就相当于加入了一支国际化的工作队伍,这支队伍的成员技术高度熟练、精通英语、而且往往还会 一门其他区域性语言。政府和企业也都认为应该为员工不断提供培训和职业发展机会,以提高他们的素质、生产效率和技能。在经济全球化的背景下,这些因素都使 得新加坡培养出的人才备受赞誉、广受欢迎。 新加坡-经济贸易国际交通枢纽 · 国际公司:约2.6万家 · 保险金融机构:5000多家 · 超过1/3的世界500强在新加坡设立总部 · 全球100多间一流的软件服务公司,80多间在新加坡设总部 · 新加坡签署了50个避免双重课税协定和30项投资保证协议 · 新加坡作为全球最大的外汇市场之一,拥有完善的金融体制,吸引许多区域财务中心在此落户。 新加坡经商环境优势: 新加坡连续9年占据《全球经商环境》榜首 2015年最有竞争力的国家全球第二 2015年全球最自由经济体排名第二 2014全球投资者情绪调查物业投资前景-新加坡No.1 新加坡优势要点 新加坡的企业税相对较低(目前利得税为17%) 海外企业可利用新加坡作为研发和知识产权平台 在六小时航程内,新加坡覆盖了全球一半人口的市场 世界大银行的聚集地,拥有首屈一指的国际金融中心 新加坡没有外汇管制,投资者更容易应对外汇风险 新加坡吸引了大量国际性人才助力企业长远发展 成熟的信用体系,严格额商务规范,非常安全的经商国度 新加坡地处亚洲中心及东西贸易路线的交汇点,是卓越的贸易及物流中心 新加坡政府的透明度与当局倡导世界一流的准则,也将公司治理风险最小化 新加坡与其他国家签署了超过70项税收条约,良好控制了经营企业的成本 海外企业以新加坡为国际贸易平台的优势 新加坡经济开放,贸易自由 自由贸易协定(FTAs):新加坡拥有21个区域和双边自由贸易协定。通过自由贸易协定,海外企业在进出口及投资时可用享受诸多优惠政策 卓越的基础设施:新加坡卓越的基础设施和优越的地理位置,为海外企业的全球业务发展提供全面的服务配套; 低融资成本:新加坡融资便利且融资成本相对低,贸易利息低于2%; 申请全球贸易商计划(GTP),离岸贸易收入可享受10%或5%的税率; 早在2014年新加坡贸易总额就达到9847亿新元,预计到2020年,在亚洲的贸易量将占全球贸易总量的60%。地处于亚洲中心及东西贸易路线的交汇点,新加坡凭借优越的地理位置,成为一个重要门户,通往多个迅速发展的经济体,如中国、印度和东南亚(东盟它们与新加坡的距离均在七小时的飞行范围内),形成了庞大的通商网络和经济发展的腹地。 新加坡是全球最佳的货柜海运和空运枢纽之一,拥有最繁忙的货柜码头。樟宜国际机场的航班则链接60个国家的270座城市,每周航班超过6600趟次。无论是乘客还是货物都能迅捷地通往世界各地,交通畅行无阻。 海外企业以新加坡作为跨国投资平台的优势 新加坡是没有外汇管制; 新加坡拥有75个全方位的避免双重税收协定(DTAs),使海外企业的新加坡公司享有税收优势; 新加坡拥有42项投资保证协议(IGA); 海外赚取收入以股息形式发回新加坡,股息免税; 新加坡无资本增值税或资本收益税 新加坡公司目前的公司税率为17% 新加坡作为国际金融中心为企业提供全面的融资方案 目前,新加坡拥有亚太地区,乃至全世界最成熟的资本市场,有多大600多加金融机构把总部设立在新加坡,其中包含诸多因素,如良好的国家信用、完善的政府监管机制,以及健全的法律制度。 投资于新加坡上市公司的国际投资人云集 新加坡广阔的资金募集市场空间 新加坡交易所仅2014年就多达41支股票和521支债券上市,包括再融资总共募集了高达1700亿美元。 在新加坡交易所上市的大型国际企业 与全球接轨的国际贸易中心 全球四大外汇市场,亚洲规模最大的新兴市场。 亚太地区领先的资产管理中心,管理资产超过131000亿美元。 全世界发展最快、最活跃的融资(债券)市场之一。 亚洲地区最成熟、最领先的金融衍生品场外交易市场。 国际领先的商铺贸易与定价中心。 人民币离岸结算中心。 新加坡有超过40000家国际企业,其中包括5000多家中国企业;5000多家印度企业,以及8300家除新加坡以外的东盟企业。世界500强中,有超过80%在新加坡设有据点或经营业务。 新加坡福智霖集团同新加坡知名大学和科研机构有长期合作,可以帮助客户对接许多尖端高科技技术的环保项目,包括污水处理,空气净化等,许多项目以其独有的专利技术已经在环保领域拓展到一定规模的市场并取得积极的市场反馈,同时,福智霖所对接的项目受到政府支持,享有政府津贴,这为技术的不断革新和市场的拓宽提供了很大便利。 新加坡 VS 中国香港 很多企业家朋友选择进军国际市场的时候,会考虑选择新加坡还是中国香港,毕竟两个地方都是国际金融中心,对于企业海外发展的金融支持力度较大。今天在这里和企业家朋友们一起来对比一下在新加坡注册公司和在香港注册公司的差别 1。新加坡地处太平洋与印度洋航运要道—马六甲海峡的出入口,注册新加坡公司其优越的地理位置与东西方文化的交融使它在世界经济贸易圈中拥有特殊的地位。新加坡不仅是重要的转口贸易中心,也是知名的国际金融中心. 新加坡常年被评为全球最易经商的国家之一 新加坡为世界知名金融中心,是企业融资发展的好地方 新加坡在全球最佳创新排行榜中占领先地位 新加坡在知识产权保护方面位居亚洲第一,世界第四 2。奉行法治及自由市场经济,信息自由流通,缔造出公平的竞争环境。香港金融中心的地位巩固,国际资金充裕,企业管治及监管水平高,是企业上市集资的最佳平台。香港位于亚洲中心,对外交通发达,区域枢纽地位无可置疑。香港的税负低廉,税制简单且透明,报税手续直接简易。香港是全球最方便营商的城市之一。

2020-08-16

e-File ECI Step 1: Before e-Filing, please ensure: You have been authorised by the company as an “Approver” for Corporate Tax (Filing and Applications) in CorpPass; and You have the company’s tax reference number, your CorpPass ID and CorpPass password. For assistance on CorpPass setup, please refer to Step-by-Step Guides. Step 2: e-File via mytax.iras.gov.sg For assistance on e-Filing, please refer to the relevant guides: User Guide – e-File Estimated Chargeable Income (Company) (PDF, 1.13MB) User Guide – e-File Estimated Chargeable Income (Tax Agent) (PDF, 1.12MB) Explanatory Notes for ECI for YA 2020 (PDF, 189KB) Companies that file their ECI in Apr 2020 will receive their NOAs […]

2020-08-15

Pay CPF Payments for CPF contributions can be made using any one of the modes listed below. Please note that CPF contribution details must be submitted together with payments for CPF contributions. “Pay Employees’ CPF Contributions as an Employer using Direct Debit Authorisation” (Form DDA (BIZ)) (PDF, 1.1MB) (More than 100,000 employers are using Direct Debit to pay CPF today!) Standing Instructions eNETS Cheques Cheques should be crossed and made payable to ‘CPF Board’. The reverse side of each cheque must bear the CPF Submission Number (CSN). All cheque payments should be accompanied by the relevant payment forms and sent to: […]

2020-08-15

CPF Submission Employers are strongly encouraged to use CPF e-Submit@web to e-submit CPF contribution details and make payment via Direct Debit. What is CPF e-Submit@Web Free web-based application developed by CPF Board CPF contribution details are submitted electronically via the CPF website Payment is deducted electronically via Direct Debit or eNETS Login is authenticated via SingPass/CorpPass Why should I use CPF e-Submit@web? Auto-computation of CPF contributions provides breakdown of the employer’s and employee’s share computation is auto-updated when an employee changes age group or year of Singapore Permanent Resident status Auto-computation of Skills Development Levy (SDL) amounts E-submit anytime, anywhere No need to […]

2020-08-15

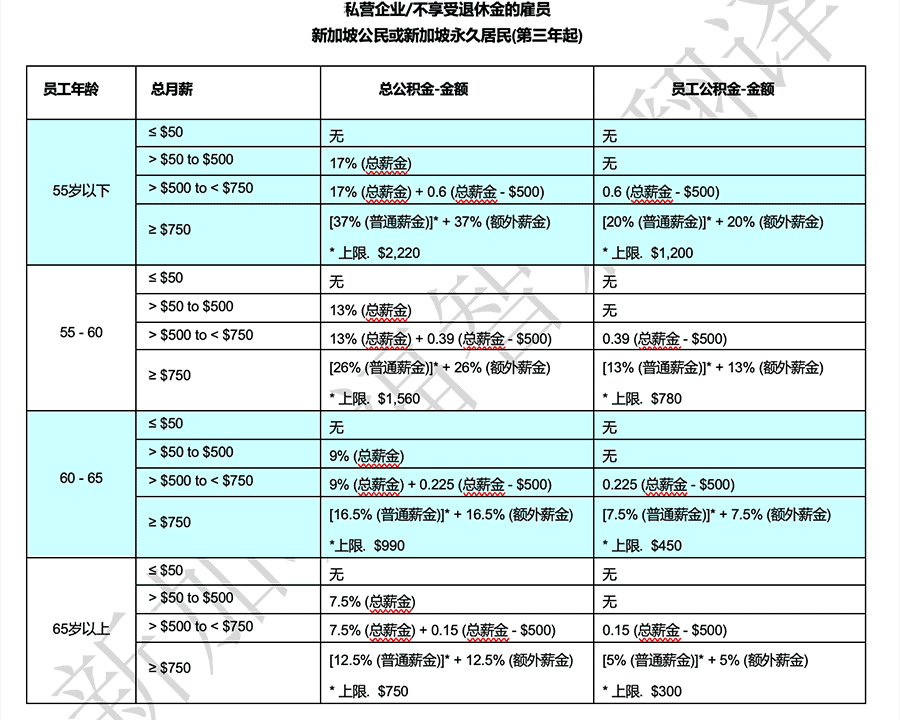

CPF Components CPF contributions for Singapore citizens and Singapore Permanent Resident (SPR) employees are paid at the prevailing CPF contribution rates. For adults under 55 years of age, 20% of the employee’s salary + an additional 17% of the employee’s salary paid by the employer is paid as CPF. https://www.cpf.gov.sg/ 本文内容由新加坡福智霖集团发布 未经许可不得抄袭,翻版必究

2020-08-15

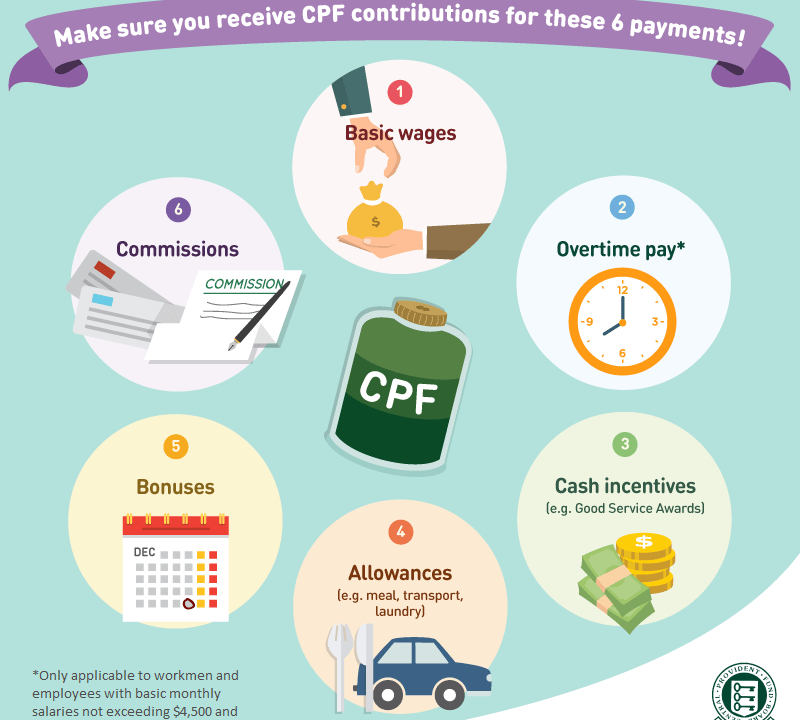

Income Subject to CPF If an employee earns more than $50 per month, his/her employer must make monthly contributions to the employee’s provident fund. If an employee earns more than $500 per month, his/her employer is entitled to recover the employee’s share from the employee’s salary. CPF contributions are payable for Singapore citizens (SC) and Singapore permanent residents (SPR) who are: Working in Singapore under a service contract; and Employed under a permanent, part-time or temporary basis. However, the CPF contribution is not compulsory if the employee is a Singapore citizen or permanent resident working overseas. The following incomes are […]

2020-08-15

Who Needs to Contribute to CPF The Central Provident Fund (CPF) is a comprehensive social security scheme that requires Singaporeans and Singapore Permanent Residents (SPRs) working in Singapore to make regular monthly contributions to the CPF. Employees who require CPF contributions You must pay CPF contributions for your employees who are Singapore citizens or Singapore permanent residents (SPRs). An employee is any person who is employed in Singapore. This includes any Singaporean seaman who is employed under a contract of service or other agreement entered into in Singapore. The following employees are also eligible for CPF contributions: Company directors. Part-time or casual […]