2020-08-17

File Corporate Income Tax The annual filing deadline for Form C-S/ C is 15 Dec for YA 2020 and 30 Nov from YA 2021 onwards. Filing Deadlines The annual filing deadline for Form C-S/ C is: Year of Assessment (YA) Due Date 2020 15 Dec 2021 Onwards 30 Nov Late Filing Submit Form C-S/ C by the filing deadlines to avoid enforcement actions such as composition or summons. The filing deadlines provide companies with at least 11 months to file from the time of closing of the accounts. Example Financial year end of company Period covered in the accounts YA […]

2020-08-17

Financial Report INTRODUCTION With regard to the financial reporting of Singapore companies, we need to understand the types of financial reports and their key components. Types of Financial Reports for Singapore Companies There are two types of financial statements – audited financial statements and unaudited financial statements. For audit-exempt private limited companies/small companies in Singapore, their accounts can be presented in the form of financial statements with unaudited accounts. For a private limited company in Singapore with an annual turnover of more than S $5 million, irrespective of whether it is exempt from audit, it must present its accounts in […]

2020-08-17

Accounting Services FOZL can tailor our accounting services to meet the needs of our clients. Accounting services include: Providing accounting services using professional accounting software, depending on the complexity and requirements of the accounts. Creating accounts in accounting software and entering accounting transactions. Preparing the following: Balance sheet Profit and loss account Cash flow statement Statement of changes in equity Breakdown of accounts The company’s financial reports

2020-08-17

Account Training In response to the needs of our client base, FOZL provides training services for our client’s accounting staff. We train our accountants to use Singapore’s accounting software systems such as MYOB, QuickBook, XERO, etc, as well as teach them how to organize and maintain important company documents. By becoming a client of our company, you can enjoy our basic financial and taxation training guidance all year round.

2020-08-17

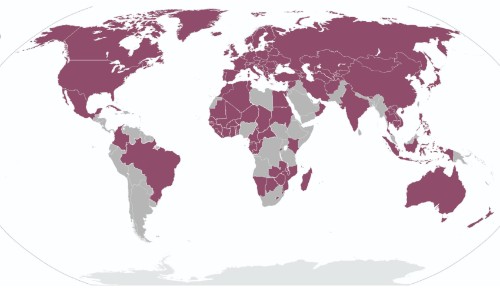

Madrid Protocol The Madrid Protocol is administered by the International Bureau of the World Intellectual Property Organization (WIPO) in Geneva, Switzerland. The Madrid Protocol provides for an international registration system for trademarks. This process has the same effect as if the application for registration of the mark had been filed in each country/region designated by the applicant. The Madrid Protocol allows trademark owners to seek protection of their marks in several countries simultaneously by filing a single application in one currency (Swiss francs), in one language and for one fee, with a single office. The Madrid Protocol is governed by […]

2020-08-17

Employment Pass If your company has sent you to work in Singapore, you may be eligible for a Work Pass, which includes a Singapore Employment Pass (EP). Here’s everything you need to know about applying for an EP. What is an employment pass? The Employment Pass (EP) is a Singapore work visa issued by the Ministry of Manpower to foreign professional employees, managers and owners or directors of Singapore companies. This work visa allows you to live and work in Singapore, as well as travel in and out of the country without the need for an entry visa. An Employment […]

2020-08-17

Banks in Singapore Banking sector and major players in Singapore Singapore is an internationally acclaimed financial centre, serving not only its domestic economy but also the entire Asia-Pacific region. The banking sector is a key player in the country’s financial market, which has quickly grown into one of the strongest industries in the world. The country’s sound economic and political environment, favourable legal and tax policies, honest institutions, and strict enforcement of laws against crime and money laundering have contributed to Singapore’s position as the second-largest international financial centre in Asia (after Hong Kong). Today, there are as many as […]

2020-08-17

VCC 15 January 2020 – The Monetary Authority of Singapore (MAS) and the Accounting and Companies Regulatory Authority (ACRA) today launched the Variable Capital Company (VCC) framework. The VCC is a new corporate structure that can be used for a wide range of investment funds and provides fund managers with greater operational flexibility and cost savings. It will encourage more funds to settle in Singapore and enhance our value as an international fund management centre. The fund manager will be able to constitute a VCC in both traditional and alternative strategies, as well as open or closed-end funds. A fund […]

2020-08-17

Fund Management Licence Singapore Fund Management Company Licence Under the Singapore Securities and Futures Act, if a company wishes to carry out (regulated) fund management services in Singapore in either of the two forms mentioned below, then the company must apply for a fund management company licence to the Monetary Authority of Singapore (MAS) or the company must hold a capital markets licence. A registered fund management company, or. Licensed fund management companies, managers of venture capital funds can also apply to operate under the Venture Capital Fund Manager (VCFM) regime. Individuals who perform key functions in a fund management […]

2020-08-17

Annual Return Services FOZL will provide the following services to help in filing the Annual Return for your company: Preparation of annual return documents Preparation of documents for the Annual General Meeting Follow up on the progress of annual return Reconciliation of company annual return documents and signatures Presentation of the company’s annual return to ACRA Archiving of annual return documents

2020-08-17

Secretarial Services Statutory Secretarial Services. Appointing a qualified statutory secretary for client companies Keeping corporate records and documents Corporate Compliance Consulting Follow up on company annual reviews and tax filing times Witnessing the signing of corporate documents Appointment, removal and change of directors and other company members Appointment, change of auditors Change of registered office Change of company name Paid-in capital of reporting companies Company capital increase Transfer of shares and submission of stamp duty on transfer of shares Reduction of the company’s registered capital Dual authentication of corporate documents sent to the Ambassador Notarized documents Other Resolutions Business […]

2020-08-17

Extraordinary General Meeting Extraordinary General Meetings (EGMs) of Singapore companies. An Extraordinary General Meeting of shareholders is a meeting of the company held in the event that important business matters require shareholder approval. Who can request a special shareholders’ meeting? An Extraordinary General Meeting (EGM) may be called by the members of the Board of Directors of a company. There are two general ways of calling an EGM: Any member holding at least 10 percent of the total number of voting rights (shares) may notify the directors of the company to convene an EGM Two or more members of the […]

2020-08-17

Share Related Services Share Capital and Variation of Rights Under the Singapore Companies Act, the Board of Directors may issue shares in the company with preferential, deferred, or other special rights or restrictions. These may be accompanied with dividends, rate of return on voting capital, or other matters, as determined by the Board of Directors by ordinary resolution, but may not affect any privileges already granted to any existing shareholder. Lien The company shall have a first priority lien on all shares (other than fully paid shares) for all moneys (whether presently payable or not) called or payable at the […]