Transfer Pricing Benchmarking and Analysis

2023-07-26

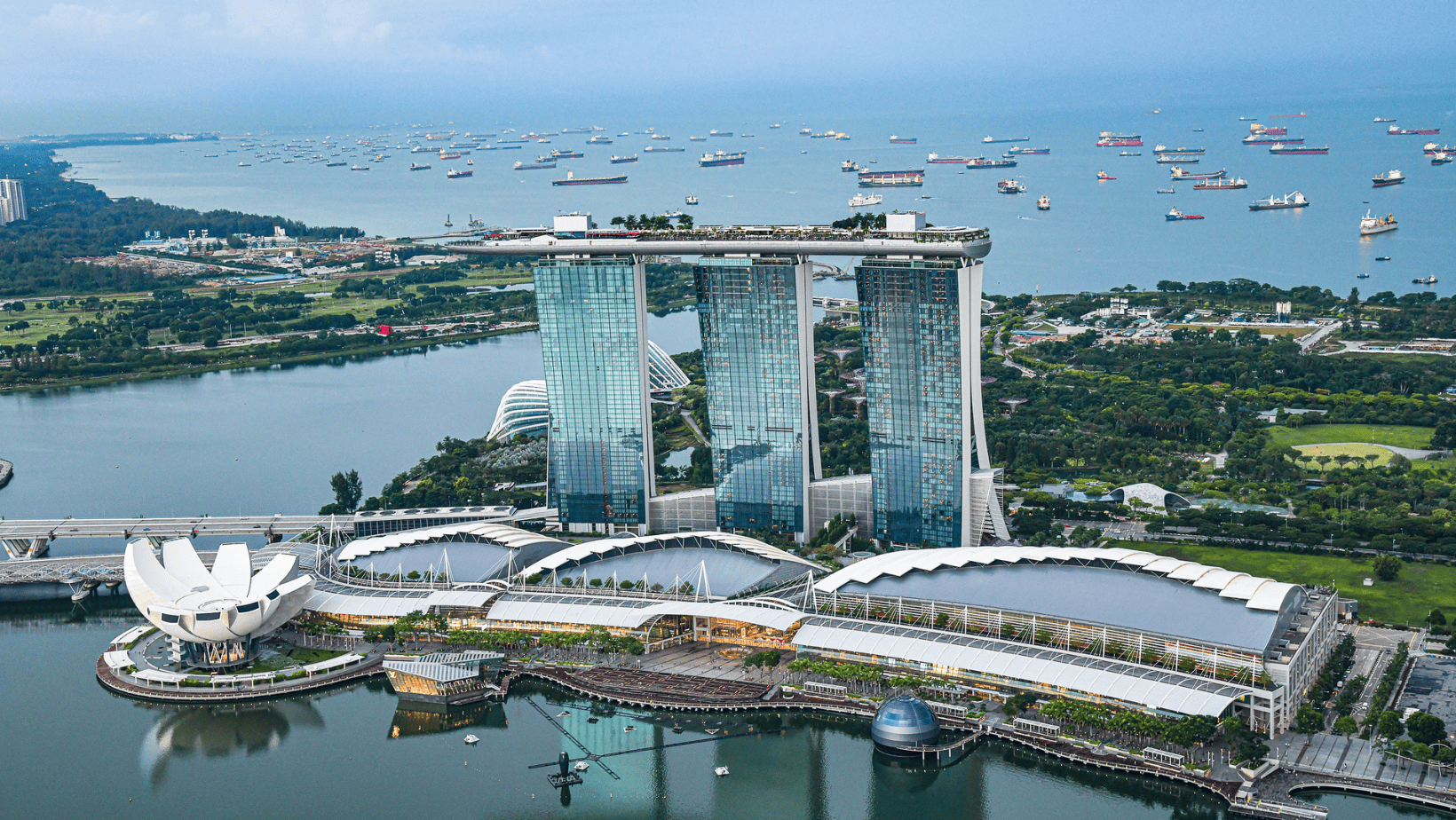

The Accounting and Corporate Regulatory Authority (ACRA) of Singapore will review the audit regulatory framework

2023-07-28

Introduction to Transfer Pricing

Introduction to Transfer Pricing

Transfer pricing (TP) is an accounting practice used to determine the prices of inter-company pricing transactions or arrangements between related parties. These can include transfers of intellectual property, tangible goods, services, loans or other financing transactions. Companies should keep in mind that the definition of “related parties” may vary between jurisdictions depending on the specific regulations and contexts. Under the Singapore Income Tax Act (ITA) section 2(1), “related party” is defined as when either party directly or indirectly controls the other, or they are under the common control of another party, whether directly or indirectly. The ITA does not specify any control or ownership thresholds to be considered related parties. In contrast, the China’s State Administration of Taxation issued the Public Notice [2016] No. 42 which provides the criteria and ownership thresholds for the purpose of determining a related party.

In recent years, TP has become more significant globally due to enhanced regulations, the impact of the BEPS project, challenges posed by the digital economy, country-specific regulatory developments and enhanced collaboration between tax jurisdictions. In 2018, the Inland Revenue Authority of Singapore (IRAS) has introduced mandatory Transfer Pricing Documentation (TPD) requirements under section 34F of the ITA applicable from Year of Assessment (YA) 2019 and every subsequent year of assessment. A taxpayer is required to prepare contemporaneous TPD to show that their related party transactions are conducted at arm’s length for a particular financial year if either of the following conditions are met (unless exemptions apply):

- Gross revenue derived from their trade or business is more than SGD 10 million for the basis period/ financial year.

- Related party transactions involving trades, loans, services, etc.

- TPD was required to be prepared for the basis period immediately before the basis period concerned.

Taxpayers are however exempt from preparing TPD if they meet any of the exemptions:

- Related party domestic transaction where the parties are subject to the same effective tax rate.

- Related party loan of any amount where the lender is not in the business of borrowing and lending money, and each party is a Singapore registered company or carries on trade or business in Singapore.

- Related party loan where the loan amount does not exceed SGD15 million and the taxpayer has applied the indicative margin set by IRAS.

- Routine support serviceson which taxpayer applies the 5% cost mark-up.

- Related party transaction covered by an advance pricing arrangement.

- The specified type of related party transaction fall below a certain threshold. (e.g. SGD15 million for sales / purchases of goods (trade related), SGD1 million for intercompany services, etc)

With effect from 10 August 2021, Transfer Pricing Guidelines (Sixth Edition) published by IRAS (Singapore TP Guidelines) was amended to enhance their powers to conduct audit on taxpayers. Non-compliance with transfer pricing rules can lead to significant penalties and additional taxes as listed below:

- A fine not more than SGD10,000 for each non-compliance offense.

- IRAS has the right to make transfer pricing adjustment under Section 34D of the ITA to increase the taxable profits.

- Imposition of a 5% surcharge on any transfer pricing adjustments made by IRAS after an assessment.

1. For more information on Singapore Income Tax Act, refer to URL link: https://sso.agc.gov.sg/Act/ITA1947?ProvIds=P11-#pr2-

2. For more information on the types of routine support services, refer to IRAS Transfer Pricing Guidelines: Annex C: https://www.iras.gov.sg/media/docs/default-source/e-tax/etaxguide_cit_transfer-pricing-guidelines_6th.pdf?sfvrsn=26bfb1a6_9