Account Opening Process

2018-07-11

Custom Registration

2018-10-11

Internet Banking and Chequebook

Introduction to Local Bank Internet Banking and Cheque Book

In Singapore, 2 weeks after the opening of a bank account, corporate online banking will be available, and companies will be able to do many of their major banking tasks from their computer or mobile phone without having to visit the bank in person.

All three major local banks in Singapore have their own online banking services.

OCBC Bank Singapore – Velocity@ocbc

Key features:

- Quickly view account summaries, payments, receipts and transaction activity.

- Quickly access more detailed reports to help customers make informed business decisions.

- Intuitive step-by-step instructions to help you get things done faster and easier.

Users can view a summary of account activity through the dashboard

The buttons for filtering, viewing and downloading account details and transaction history are all on one page

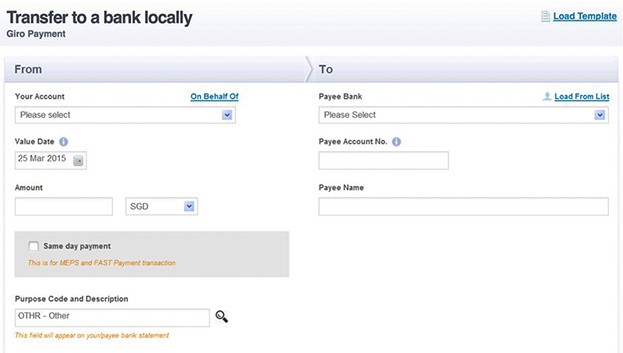

Performing a bank transfer requires only a few simple steps

You may save operations such as bank transfers as templates

You may check the status of the business and templates on the same page.

Among them, OCBC offers 4 service packages for enterprises to choose from, and the “Classic” package is the most popular. It allows two users to jointly operate the account, with one user given the rights to create transactions, while the other user may carry out authorization and monitoring operations via their mobile phone. Of course, enterprises can also choose more advanced packages according to their own business needs, as shown below.

DBS Bank Singapore – DBS IDEAL

In addition to the usual features, DBS IDEAL Online Banking has the following features.

- Seamless integration can be achieved through fast application processes and integration with ERP systems.

- High financial security with the cutting-edge security features of DBS Ideal Digital Token+

The DBS Ideal Digital Token+, with the following features.

–High security

–No physical tokens and text messages, just click and swipe to authenticate. You can easily log in using your smartphone’s fingerprint recognition.

–Secure 2FA biometric authentication via fingerprint or facial recognition.

–High flexibility of the customised security mechanism. You can set up multiple signatory groups and an approval matrix to fit your daily operations.

- Simple maintenance and administration of the module to create users, set up features and grant access

- Access to various business functions on a platform that supports multiple locations, languages and currencies

- Provide comprehensive loan inquiry and other loan transaction services

- It is possible to set the company’s transaction authorization policy with different levels of control. You will have the ability to specify different controls based on the transaction amount and service type:

- Single or multiple levels of authorization

- Different combinations of mandated groups

- Sequential or parallel approval from different authorization groups

Unlike OCBC, DBS IDEAL offers a unified standard service package for all corporate users including enquiry, payment, payroll, collection, trading, forex booking, etc.

UOB Bank Singapore – BIBPlus

UOB’s Business Internet Banking Plus (BIBPlus) is UOB’s enhanced business internet banking platform for corporate customers. The platform provides users with a comprehensive range of cash management, transaction and treasury services.

Depending on the service package (and advanced options) registered by the business, users can utilize BIBPlus to perform the following functions:

Account Enquiry

Check Current and Time Deposit Accounts

View account balance (summary and details)

View Loan Overview

View Internal Wire Transfer

View the balance of currency options

Download, export and print reports, recommendations and notifications

Cheque Service

Cheque status inquiries (single or multiple)

Issuance of stop-cheque requests (single or multiple)

Issuance of new chequebook requests (maximum of 2)

Download Daily Check Reconciliation Archive

Local payments

Transferring funds to your UOB account:

-To your own account at UOB.

Transferring to UOB’s third-party account

-Supports transfers in the same (e.g. S$ to S$) and different currencies (e.g. USD to S$).

Transfer of funds to other bank accounts in Singapore (via FAST/GIRO)

-Support for SGD only

Support for post and repeat instructions

Instalment Payments

Payments to different billing agencies

time deposit

Placing Singapore Dollar Time Deposits and Foreign Currency Time Deposits

Remittance

Transfer of funds from UOB accounts to other bank accounts (both local and international)

Cashier’s checks/current drafts

Requests for demand drafts and bank drafts

Payslips – Wages paid to employees, (with UOB or other bank accounts in Singapore)

Bulk payments by cashier’s check, cheque (special setting required), local payment and money transfer

Bulk collection – directly from customers

Upload transaction files to generate payroll, accounts receivable or accounts payable system

Create and save transaction files through online data entry

View and download returned fate files to check the processing status

Trade services

Check all outstanding trade documents

Applications for Import Letters of Credit

Request for Amendment of Letter of Credit

Notification, confirmation and transfer of letters of credit

Application for a ship’s bond

Application for a bank guarantee

Payment of trust receipts

View and respond to various notices

Other functions

Group companies – use a single group ID to link the accounts of affiliated companies for inquiries and/or transactions

Approvals – approving multiple transactions at once

Online Productivity Toolkit:

– Create and save templates for future reuse

– Save transactions as drafts

– Frequently used data can be maintained as lookup tables.

Cross-currency fund transfers, term deposits and remittances using previously concluded foreign exchange contracts with banks

Enhanced Functions

– Global view – access to BIBPlus’ single ID and security token in multiple countries

– Financial supply chain management

– Trade – Export collection and clean invoice financing

– Universal file upload

– Merge/separate records from files; set approvals based on the maximum transaction amount

– Proxy/remote authorization

– Pre-approved beneficiaries

– Email alerts – set up notifications to track the progress of transaction processing

– External accounts (MT940 and MT101) -View account balances and initiate payments from accounts with other banks.

– MT103 copies

About Cheques

Cheques are a very common form of payment in Singapore and are usually accepted by businesses and individuals alike. However, it is important to note that when a cheque is issued, it is important to ensure that the balance is sufficient to cover it. If a cheque bounces, it can affect the credit history of the issuer, which in this case is the company.

A cheque is an instrument issued by the drawer and entrusted to the bank that handles check deposit business to pay a determined amount to the payee or bearer unconditionally at the sight of the check; units and individual customers who have opened deposit accounts with banks for various sums of money for intercity transactions can issue transfer checks and entrust the opening bank to handle payment procedures. Transfer cheques are valid for 10 days from the date of the cheque and are extended in case of holidays.

What is a transfer cheque?

A transfer cheque is a document issued by an entity that notifies the bank that money is being withdrawn from its account. A transfer cheque can only be used to transfer funds, not to withdraw cash. It applies to the settlement of commodity transactions, labour supply and other economic transactions between units. The transfer cheque is issued by the paying unit and handed over to the receiving unit, and the receiving unit is not allowed to be entrusted to sign on behalf of the paying unit; it is not allowed to issue blank cheques and forward cheques; it is not allowed to lend out cheques. The use of transfer cheques by all units must comply with the relevant regulations of banks.

Features of the transfer of cheques

1. Minimum amount limits.

2. Cheques for the transfer of funds may only be used to transfer funds and may not be used to withdraw cash.

3. The transfer of a cheque may be endorsed to other creditors.

4. Cheques issued by the customer may be handed over directly to the payee, who will transfer them to his bank account.

5. The name of the payee and the amount of the transfer check may be added by the drawer’s authorization, and no endorsement of the transfer, or prompt payment, shall be made without such an addition.

Check transfer process

- Issuance of cheques: the customer issues a cheque for the transfer of funds according to the unit’s situation, with a reserved bank seal.

- Delivery of bills: the issuing customer will hand over the bills to the payee (or go directly to the account bank to handle the payment procedures).

- Circulation and use of bills: the payee or the holder endorses the transfer check for transfer according to the needs of the transaction.

- The payee or the holder of the cheque will entrust the payee or the holder of the cheque to pay the cheque at the bank of the account of the drawer. When the payee prompts the payment, he or she should endorse the payment by entrusting it to the payee, and sign on the back of the transfer check at the place of “endorser’s signature”, indicating the words “entrusted to pay”. Suspension of payment: If the transfer check is lost and the loser needs to suspend payment, he shall fill out and sign a notice of suspension of payment.

How many days are transfer checks valid?

The validity of a transfer cheque is calculated from the date of issuance of the cheque and is valid for 10 days, or postponed if the tenth day is a holiday (the validity of the cheque is calculated from the day after its issuance, and is postponed on holidays). The bank will not accept a cheque after the payment period; the power of a transfer cheque is valid for six months from the date of issuance of the cheque, and within six months from the date of issuance of the cheque, the payee may request payment from the payer with relevant supporting documents.

The difference between a transfer check and a cash check

1. Definitions

(1) Transfer cheques. A transfer cheque is an instrument issued by the drawer of a cheque, and the bank entrusted with the business of depositing cheques pays a determined amount to the payee or bearer unconditionally upon seeing the cheque; units and individual customers who have opened deposit accounts with banks may issue transfer cheques and entrust the account-keeping bank with the payment of various sums of money used for transactions in the same city. Transfer checks can only be used to transfer funds. A transfer cheque is the most basic type of payment and settlement business in the same city, and can only be used locally (it can already be used to transfer money to other places).

(2) Cash cheques. A cashier’s cheque is a type of cheque made specifically for the withdrawal of cash. It is issued by the depositor for the purpose of withdrawing cash from a bank for his own account, or it may be issued to other entities and individuals for the purpose of settling accounts or for the purpose of entrusting a bank to pay cash to a payee on his behalf.

2. Usage

(1) Transfer of cheques. Only transfers, not cash withdrawals.

(2) Cash cheque. Only cash can be withdrawn, not transferred.

3. Endorsements

(1) Transfer cheques. A transfer check may be endorsed for transfer.

(2) Cash Checks. Cash cheques can not be endorsed for transfer.

How do you cash a transfer check?

There are two methods of cashing checks into the account, one is to hand the check directly to the recipient bank by filling out the input statement and passing it to the bank teller. The processing of the cheque takes about 1-2 days.

The check account bank receives the payment instruction, then the money is transferred to the account of the bank where the recipient is located.

A faster way is to go to the bank account of the check for the account, which is also called active payment or reverse bank check. The principle of exchange is that the bank account of the check directly transfers the money to the account of the bank where the check is drawn, and this way the request process is shortened, so it is faster.

How to write a cheque in Singapore

1. Use a blue and black permanent marker to fill in the form.

2. Fill in the form in regular capital letters

3. Underline the word “Bear” if there is a named party on the check.

4. If the cheque is not for encashment, please write “Account Payee Only” in the upper left corner of the cheque with two lines so that the cheque cannot be transferred.

5. Make sure the date is written in the date box provided at the top right, no future dates are allowed.

6. Ensure that the amount is filled in using English words with capital letters and do not leave any unnecessary gaps to prevent tampering.

7. Ensure that the cheque signature is filled in

8. The signature needs to be the same signature used in the bank application to open an account.

9. If there are any changes that need to be made, cross them out with a vertical line and sign next to them.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580