Who Needs to Contribute to CPF

2020-08-15

CPF Components

2020-08-15

Income Subject to CPF

If an employee earns more than $50 per month, his/her employer must make monthly contributions to the employee’s provident fund. If an employee earns more than $500 per month, his/her employer is entitled to recover the employee’s share from the employee’s salary.

CPF contributions are payable for Singapore citizens (SC) and Singapore permanent residents (SPR) who are:

Working in Singapore under a service contract; and

Employed under a permanent, part-time or temporary basis.

However, the CPF contribution is not compulsory if the employee is a Singapore citizen or permanent resident working overseas.

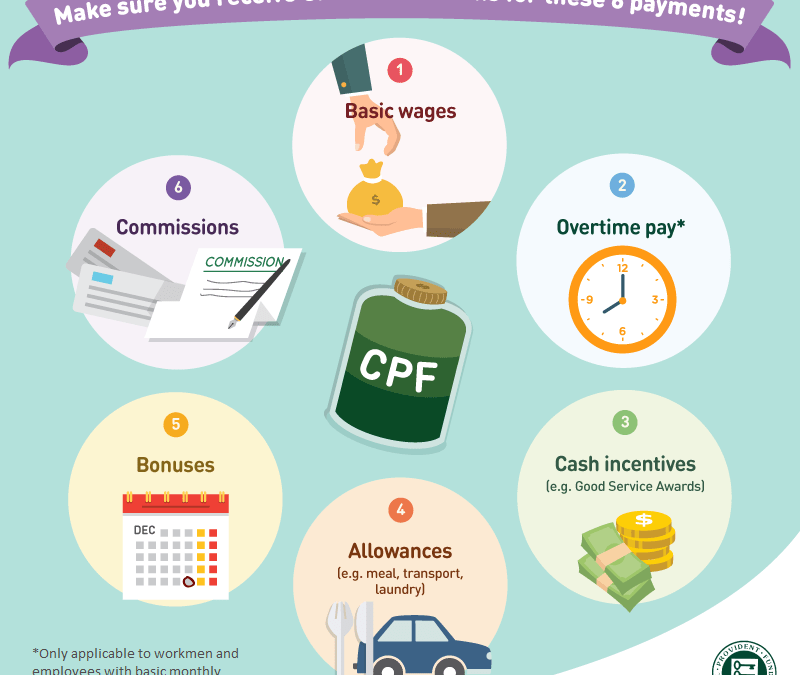

The following incomes are subject to CPF

- Basic salary

- Overtime pay

- Cash incentives

- Allowance

- Bonuses

- Commission

![]()

本文内容由新加坡福智霖集团发布

未经许可不得抄袭,翻版必究

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580