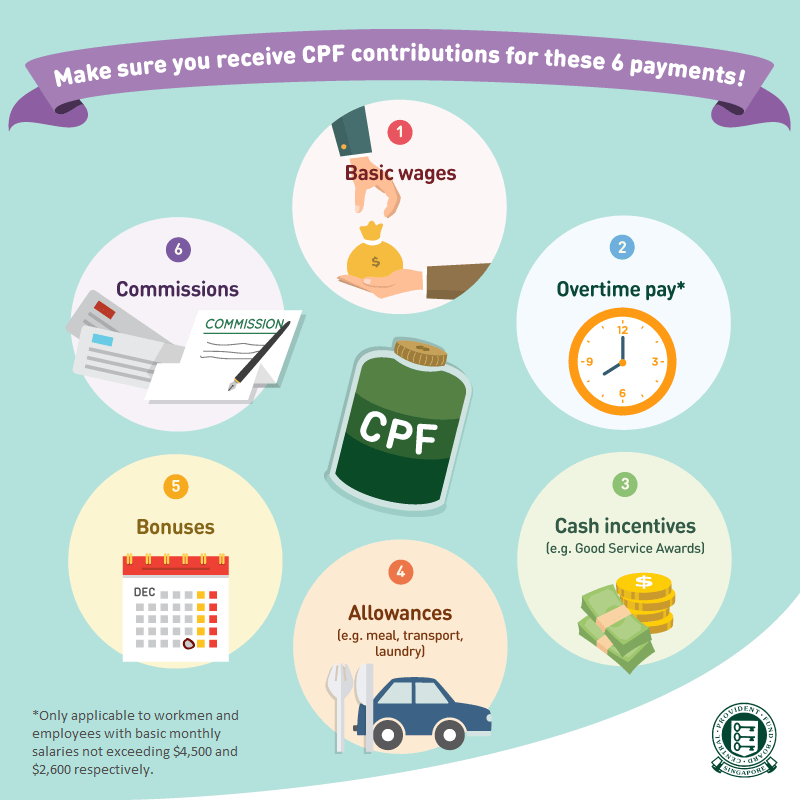

Income Subject to CPF

2020-08-15

CPF Submission

2020-08-15

CPF Components

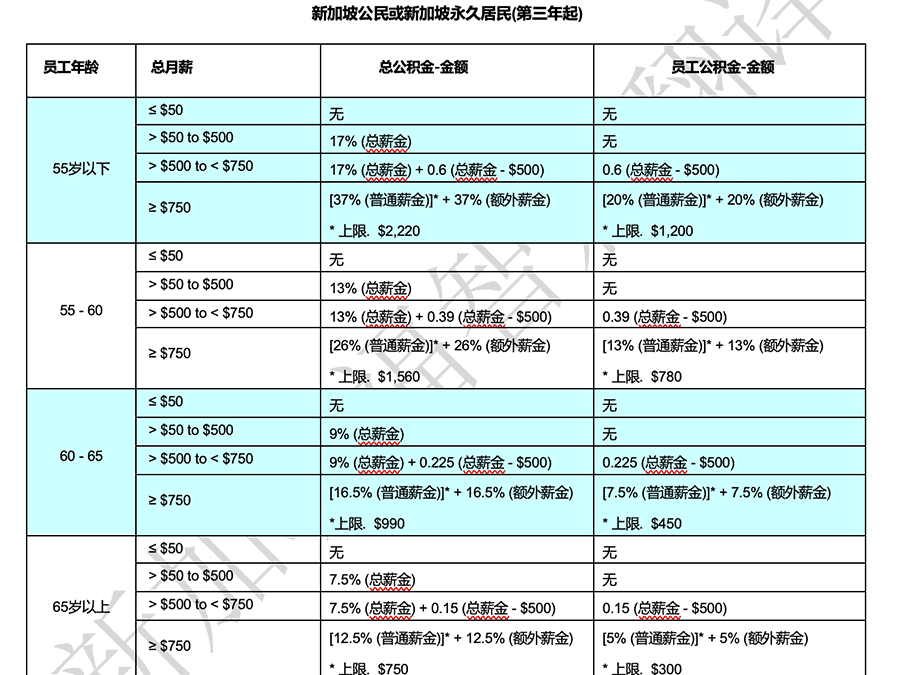

CPF contributions for Singapore citizens and Singapore Permanent Resident (SPR) employees are paid at the prevailing CPF contribution rates.

For adults under 55 years of age, 20% of the employee’s salary + an additional 17% of the employee’s salary paid by the employer is paid as CPF.

https://www.cpf.gov.sg/

![]()

本文内容由新加坡福智霖集团发布

未经许可不得抄袭,翻版必究

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580