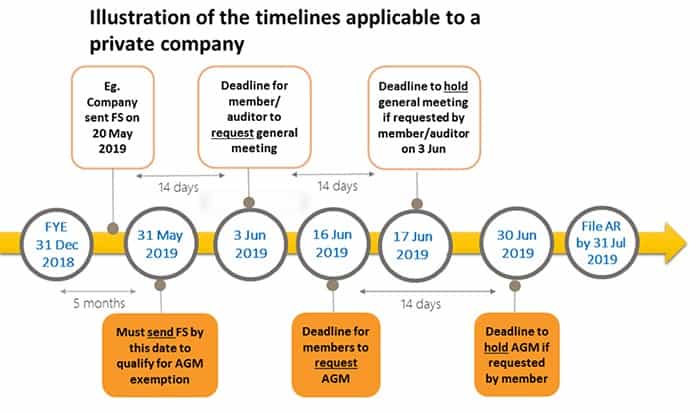

Annual Return Timeline

2018-03-07

Withholding Tax Filing

2018-04-05

Audit Process

Appointment of Auditors

For Singapore companies that meet the audit requirements, the directors of the company must appoint the auditors within three months of the company’s incorporation. The term of office of the auditor is from the date of his appointment to the conclusion of the next annual general meeting of the company. Therefore, when an auditor is first appointed by a newly incorporated Singapore company, the auditor will serve until the conclusion of the company’s first annual general meeting (AGM). Then, during the first AGM, the company must appoint a new accounting entity (or reappoint the same accounting entity) to act as the company’s auditor until the conclusion of the next AGM. The auditor will remain in office until the conclusion of the company’s subsequent annual general meeting. If the directors fail to appoint a company auditor, any member of the company may apply to ACRA for a company auditor to be appointed by them. The removal of the Company’s auditor may be determined by a resolution passed by special notice at a general meeting of shareholders.

To ensure the success of the audit, six specific steps should be followed during the audit:

Request for financial documents

After notifying the organization of an impending audit, the auditor usually requests the documents listed on the preliminary audit checklist. These documents may include a copy of the previous audit report, original bank statements, receipts and ledgers. In addition, the auditor may request an organizational chart, copies of board and committee minutes, and copies of the bylaws and current rules.

Preparation of the audit plan

The auditor reviews the information in the document and plans how to conduct the audit. A risk workshop may be held to identify possible problems. An audit plan is then drafted.

Schedule a meeting

Senior management and key executives are then invited to an open meeting where the auditors present the scope of the audit. A time frame for the audit is established and any timing issues, such as scheduled leave, are discussed and addressed. The Head of Department may be asked to inform staff of a possible interview with the auditor.

Conduct on-site site visits

The auditor uses the information gathered from the meetings and uses it to finalize the audit plan. Fieldwork is then performed by talking to staff and reviewing procedures and processes. The auditor tests whether policies and procedures are being followed. Internal controls are evaluated to ensure they are adequate. The auditor can discuss issues as they arise, giving the organization an opportunity to respond.

Reports are drafted

The auditor prepares a report detailing the results of the audit. The report includes mathematical errors, entry problems, approved but unpaid payments and other discrepancies; other audit issues are also listed. The auditor then prepares a commentary describing the audit findings and recommended solutions to any problems.

Organization of the closing session

The auditors request a response from management indicating whether they agreed or disagreed with the issues in the report, the management’s action plan to address the issues and the expected completion date. At the closing meeting, the report and management’s response are discussed by the parties concerned. If there are any remaining issues, they are resolved at this time.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580