Local Payments

2018-05-02

Business Secretary

2018-05-19

Annual Return Process

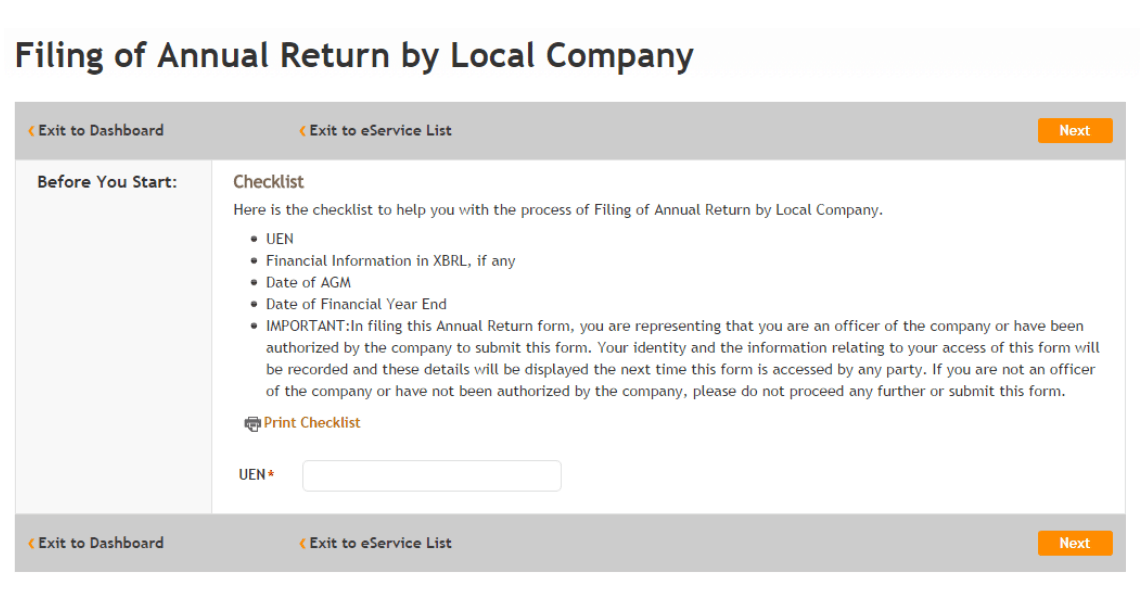

Under the Singapore Companies Act, every Singapore company is required to file an annual return filing with the relevant government agency every year. These annual return requirements are mandatory and include the following:

- Preparation of accounts, completing the company’s accounts for the previous financial year in accordance with Singapore Accounting Standards.

- Prepare the company’s financial report per the Singapore Financial Reporting Standard (SFRS).

- Convene the Annual General Meeting (AGM) of the company. If the company is eligible, it can also apply to not hold an Annual General Meeting. It may choose to circulate the financial statements to the directors for signing instead.

- The signing of resolutions, declarations, and other relevant documents by the directors of the company for the annual audit.

- Submission of the application for the Annual General Meeting to ACRA with the relevant documents.

- After the annual audit, download and file the latest Bizfile, the company’s registration document.

*Once the annual return is completed, do not forget to file the appropriate tax returns with the tax authorities.

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580