Update Company Information

2018-07-10

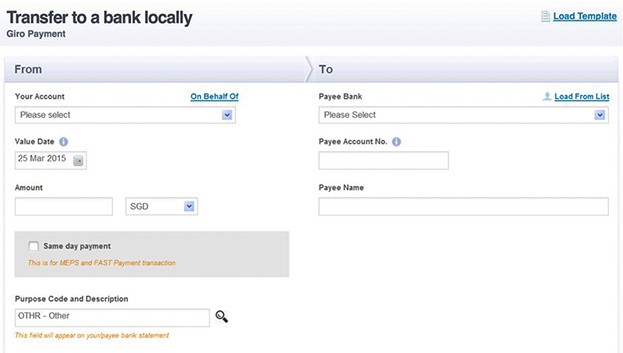

Internet Banking and Chequebook

2018-10-05

Account Opening Process

1

Incorporate Singapore Company

When opening a bank account in Singapore, companies that are registered in Singapore are given priority. The company does not necessarily have to be situated in Singapore, as Singapore's government and banks accept companies with offshore operations. Chinese entrepreneurs with companies registered in Singapore need only find a Singaporean corporate services provider to apply to open a bank account in Singapore!

In addition to Singapore-registered companies, Singapore banks also accept companies that are registered in common law jurisdictions, such as the UK, Hong Kong, BVI, Cayman Islands, etc.

Note: Local banks in Singapore do not accept direct applications for account opening from mainland Chinese enterprises, as the difference in company law between the two places is too great to be reasonably controlled.

In addition to Singapore-registered companies, Singapore banks also accept companies that are registered in common law jurisdictions, such as the UK, Hong Kong, BVI, Cayman Islands, etc.

Note: Local banks in Singapore do not accept direct applications for account opening from mainland Chinese enterprises, as the difference in company law between the two places is too great to be reasonably controlled.

2

Choose Your Preferred Bank

The top 3 Local Banks in Singapore are OCBC, UOB and DBS.

. Local banks offer more comprehensive and advantageous services, which not only make it easier to use your bank account but also make it easier to access further financial services, discounts, loans and more

. For companies with a background in mainland China, they can also choose branches of Chinese banks in Singapore, such as the Singapore branches of Bank of China and Agricultural Bank of China.

. In particular, companies in mainland China already have a long-standing relationship with banks in the country, which can lessen examination time and improve account opening efficiency

The bank needs to be chosen based on the latest requirements of the bank and the current situation of the business.

. Local banks offer more comprehensive and advantageous services, which not only make it easier to use your bank account but also make it easier to access further financial services, discounts, loans and more

. For companies with a background in mainland China, they can also choose branches of Chinese banks in Singapore, such as the Singapore branches of Bank of China and Agricultural Bank of China.

. In particular, companies in mainland China already have a long-standing relationship with banks in the country, which can lessen examination time and improve account opening efficiency

The bank needs to be chosen based on the latest requirements of the bank and the current situation of the business.

3

Secretary Books An Appointment With The Bank

4

Secretary Prepares The Documents Required

Documents include:

Personal documents, usually the passports, of the directors and shareholders of the company

Singaporeans may provide ID: proof of address

Bank bills, utility bills within 3 months

Phone bills, etc. can be used as proof of address documents

Official documents for opening a business, including certificate of registration, articles of association

. The latest annual audit documents, documents of changes in the company, etc.

For Islands companies, an up-to-date agent certification letter Incumbency

is also required. The most important information: documents proving the contents of the business and the transactions of the enterprise

. Including sales and purchase contracts signed or intended to be signed

Information on major suppliers and major customers

Information on expected annual turnover, expected monthly incoming and outgoing account amounts, etc.

Personal documents, usually the passports, of the directors and shareholders of the company

Singaporeans may provide ID: proof of address

Bank bills, utility bills within 3 months

Phone bills, etc. can be used as proof of address documents

Official documents for opening a business, including certificate of registration, articles of association

. The latest annual audit documents, documents of changes in the company, etc.

For Islands companies, an up-to-date agent certification letter Incumbency

is also required. The most important information: documents proving the contents of the business and the transactions of the enterprise

. Including sales and purchase contracts signed or intended to be signed

Information on major suppliers and major customers

Information on expected annual turnover, expected monthly incoming and outgoing account amounts, etc.

5

Submit for Bank Review

Special Reminder

The information provided to open an account, including business references, must be correct.

Banks' due diligence regulations are becoming more stringent in case of involvement in fraud or identifiable risks.

Banks will freeze or close accounts, which can cause unnecessary problems for the business.

This will have a negative impact on the personal creditworthiness of the directors and shareholders.

.

The information provided to open an account, including business references, must be correct.

Banks' due diligence regulations are becoming more stringent in case of involvement in fraud or identifiable risks.

Banks will freeze or close accounts, which can cause unnecessary problems for the business.

This will have a negative impact on the personal creditworthiness of the directors and shareholders.

.

6

Witness Signature

**All originals may be witnessed by:**

Banking Officer

Company Secretary

Registered Lawyer

Certified Public Accountant

Banking Officer

Company Secretary

Registered Lawyer

Certified Public Accountant

7

Processing Time 2-4 Weeks

The authorized signatory receives an email notification from the bank after successful account opening and activates eBanking

Receive your checkbook in 1-2 more weeks

**Please make the minimum deposit within 3 working days after the account is opened, otherwise, the bank has the right to close the company's account**

Receive your checkbook in 1-2 more weeks

**Please make the minimum deposit within 3 working days after the account is opened, otherwise, the bank has the right to close the company's account**

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580